Prepare yourself by knowing the less-obvious costs of owning a home. Insurance, maintenance and more add up faster than you think. Buyers too often focus on a home’s list price or mortgage payment to determine what they can afford. However, the less-obvious costs associated with homeownership can affect the monthly bottom line. To help home […]

Tag Archives: Tips for Buyers

Should You Forgo the Home Inspection to Improve the Chances of Beating Out Other Buyers

If you’ve been aching to buy a home but haven’t been able to seal the deal we feel your pain. After all, pent-up demand left over from tight supply over the past two years, against the backdrop of mortgage rates remaining near historic lows, combined with continued low inventory levels and fewer homes for sale […]

How to Improve Your Credit Score

So you’re considering buying a home and you’ve got it all planned out: a four-bedroom home in the top local school district and your favorite neighborhood including a manicured lawn, a finished basement with a theater room and—why not?—an outdoor kitchen. Slow down… one of the first steps in buying a home is to clean up your credit score, also called a […]

Interpreting Foundation Cracks

Houses, no matter their age, will shift and settle over time resulting in cracks. Cracks may appear in either finishes or structural components. Though they usually have no structural significance, it’s worth some detective work to help homeowners understand the difference between different types of foundation cracks. Here are some visual guidelines: Shrinkage Cracks Concrete […]

Self-Employed? Keys to Getting Approved for a Mortgage and Buying a Home

If you’re self-employed your office might be a built-in desk in the corner of a spare bedroom, a downtown co-working space, or the front seat of your car. The Bureau of Labor Statistics reports there are 15 million self-employed workers in America living the dream, being their own boss. Sure, it can be a struggle, […]

Tips to Buying a New Home

Buying a new home entails an entirely different set of issues than buying a pre-owned (existing) home. You have access to more information on the building materials and systems than you do on existing construction and as a subsequent buyer, but unknowns lurk, including: What will the completed neighborhood look like? Will it include all […]

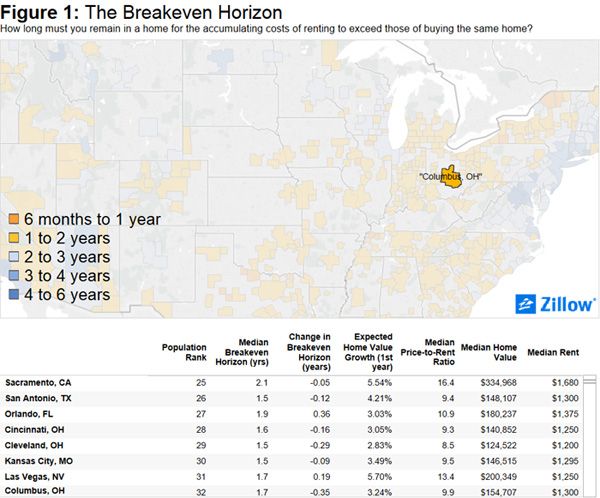

Consider the Breakeven Horizon When Evaluating the Rent/Buy Equation

With spring comes change. Time to change your wardrobe, your flower beds and, potentially, the way you live and your housing situation. As the home shopping season heats up, we’re again compelled to tackle the classic housing question: To buy or to rent? The decision whether to buy a home is difficult. It’s not just […]

Do I Need a Buyer’s Agent When Buying a New Home?

6 Real Estate Secrets from Investors

You’ve seen the TV shows: Individual finds a foreclosed home in the best neighborhood in town, scoops up said property for a steal, fixes it up, and sells it for a significant profit. What those DIY and home improvement shows don’t necessarily show you is just how tough flipping houses for a profit can actually be. But […]

Tips to Avoid Over-Improving Your Home

Can your house ever be too nice? The answer is yes. Unfortunately, there’s no simple measure to determine what constitutes an over improvement. How much is too much, depends a lot on what improvements you undertake, what’s happening in your neighborhood and, in the end, your personal reasons for improving. That said, when you sell […]