When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Tag Archives: Mortgage Loan

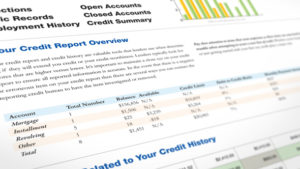

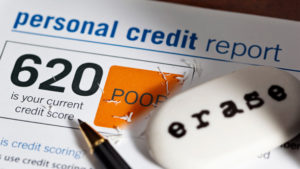

What is a Good Credit Score and What Do You Need to Buy a Home?

No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, […]

Employers Can Now Contribute to Workers’ Down Payments

A new program allows employers to help workers’ down payment on a home, similar to how companies contribute to a 401(k). HomeFundMe, a Fannie Mae and Freddie Mac-approved down payment crowdfunding platform, allows borrowers to crowdfund their down payment from several sources, including their employer. CMG Financial, a mortgage banking firm, created the HomeFundMe program. Employers can […]

How to Improve Your Credit Score

So you’re considering buying a home and you’ve got it all planned out: a four-bedroom home in the top local school district and your favorite neighborhood including a manicured lawn, a finished basement with a theater room and—why not?—an outdoor kitchen. Slow down… one of the first steps in buying a home is to clean up your credit score, also called a […]

Loan Estimate and Closing Disclosure

A Loan Estimate (LE) is a form that lists basic information about the terms of a mortgage loan for which you’ve applied. The idea behind the Loan Estimate (like the Good Faith Estimate before it) is to get critical information about the loan into the hands of the borrower as early as possible so that you as […]

Mortgage Rates Move from Dirt Cheap, to Cheap

The same home you considered buying a year ago with a $200,000 mortgage would now cost about $90 more in interest payments per month, or about $1,080 per year, given the rise in mortgage rates since last year. But let’s put this increase into perspective – and take the long view. One thing seems certain: […]

How Long Does it Take to Close on a Home Purchase

How long does it take to close on a home purchase? If you are a cash buyer theoretically you can close as soon as you like. If you intend to finance your purchase with a mortgage the process can take a bit longer. Average Purchase Closing Time : 30 Days Nationwide, as demand and competition for homes for […]