No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, getting a mortgage will be a breeze; if it’s low, you may struggle.

So now that we’ve got your attention, the question remains: Exactly what is a good credit score?

The Credit Score You Need to Buy a Home3

A credit score of 700-plus will usually land a borrower a lower interest rate however, you can still qualify for a mortgage with a score as low as 500, the 700s are where you can expect to pay the lowest rates.

A good score is from 700 to 759; a fair score is from 650 to 699. Since a lower score means you’ve had some late payments or other dings on your credit history, lenders see you as a greater risk and potentially more likely to default on your home loan. They will still likely give you a mortgage, but at a higher interest rate.

Credit scores below 650 are deemed poor, meaning your credit history has had some rough patches. This doesn’t necessarily mean you can’t qualify for a loan, but it may be tough, and again you’ll pay a higher interest rate for the privilege.

The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. For instance, if your score drops to 740 from 760, you’re likely to see a small bump up in the rate you’ll be offered.

To qualify for a conventional loan, you’ll typically need a credit score of at least 620. Borrowers with credit scores of 740 or higher can make lower down payments and tend to get the most attractive conventional loan rates

If you’ve had some credit issues in the past, an FHA Loan may be the best option for you. To qualify for an FHA loan, applicants are now required to have a minimum credit score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent. If your credit score is below 580, however, you aren’t necessarily excluded from FHA loan eligibility. Applicants with lower credit scores will have to put down a 10 percent down payment if they want to qualify for a loan.

What Credit Score Do You Need to Get the Best Mortgage Rate?

Here’s the deal: A perfect credit score is 850. But all scores 760 and above are considered to be in the excellent, or best credit score range. Since this means you’ve shown an excellent ability to pay off your past debts, mortgage lenders want your business—and will try to entice you by offering loans with the lowest interest rates.

That said, the best mortgage rates typically go to borrowers with a credit score of 720-740 or better. Since mortgage rates are based on credit tiers, even raising your score just a few points can sometimes earn you a better rate. For instance, boosting your FICO score from 735 to 740 before buying a home could make a big difference in your rate and monthly mortgage payment and it’s important that you ask your lender what credit score is required to qualify for their best rates.

Mortgage Where Credit Score Matters Less

With conventional loans — those backed by Fannie Mae and Freddie Mac — a lot of focus is put on your credit score.

The impact of a lower score won’t be as significant on some types of loans as it would be with a conventional loan. For the best interest rates on a Federal Housing Administration (FHA Loan) or Department of Veterans Affairs loan (VA Loan), the credit score threshold isn’t 760 (as it is with conventional loans), it’s 700-plus.

- For an FHA loan, you may be able to have a score as low as 500.

- VA loans don’t require a minimum FICO score, although lenders making VA loans typically want a score of 620 or higher.

- USDA loans backed by the Agriculture Department usually require a minimum score of 640.

It is worth mentioning that these credit score guidelines don’t tell the entire story as most lenders have “overlays,” which are extra requirements or standards that allow them to require higher credit scores, regardless of mortgage type.

While there is some leniency on credit scores and underwriting guidelines with government loans, the fees on these loans are higher. For example you’ll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

How Mortgage Rates Can Vary By Credit Score

Let’s consider how a 100-point difference in credit score would impact the mortgage interest rate, and in turn the monthly mortgage payment.

Suppose a borrower looking to buy a home worth $300,000 has a 20% down payment and applies for a 30-year fixed-rate loan of $240,000. She has a 780 FICO credit score, which gets her a 4% rate. That’s around $1,164 a month, not including taxes, insurance or homeowners association fees.

If this borrower’s score dropped by about 100 points to between 680-699, her rate could increase to approximately 4.5%. At that interest rate, her monthly payment would increase to $1,216, an extra $62 a month, or $744 per year.

The effect of the difference in these mortgage interest rates may not seem significant at first, but over the term of the mortgage it adds up. In this example, a 100-point-drop results in the borrower paying an additional $25,300 over 30 years.

If your score is already good, you should consider taking the rate you qualify for. Industry professionals advise against taking too long to fine-tune an already-good credit score as rates could go up in the meantime and offset any benefit of a slightly higher score.

How credit scores are calculated

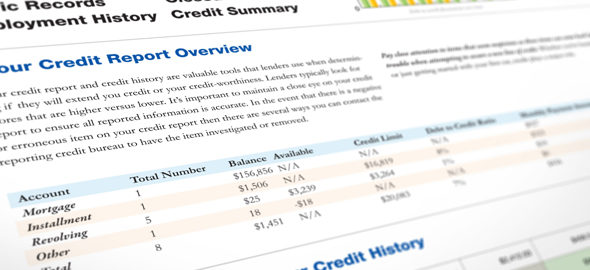

Three major U.S. credit bureaus track and tally your scores: Experian, Equifax, and TransUnion. Their scores should be roughly similar, although each pulls from slightly different sources (Experian looks at rent payments while TransUnion checks out your employment history). But by and large, here are the main variables that determine your score, and to what degree:

- Payment history (35%): This is whether you’ve made debt payments on time. If you’ve never missed a payment, a 30-day delinquency can cause as much as a 90- to 110-point drop in your score.

- Debt-to-credit utilization (30%): This is how much debt you’ve accumulated on your credit card accounts, divided by the credit limit on the sum of your accounts. Ratios above 30% work against you. So if you have a total credit limit of $5,000, you will want to be in debt no more than $1,500 when you apply for a mortgage.

- Length of credit history (15%): It’s beneficial to have a track record of being a responsible credit user. A longer credit history boosts your score. CreditKarma.com, a credit-monitoring service, found that its members with scores above 750 have an average credit history of 7.5 years.

- Credit mix (10%): Your credit score ticks up if you have a rich combination of different types of credit accounts, such as credit cards, retail store credit cards, installment loans, and a previous mortgage.

- New credit (10%): Research shows that opening several new credit accounts within a short period of time represents greater risk to the mortgage lender, according to myFICO.com, so avoid applying for new credit accounts if you’re about to buy a home. Also, each time you open a new credit account, the average length of your credit history decreases (further hurting your credit score).

- You’re entitled to a free copy of your full credit report at AnnualCreditReport.com. Keep in mind, the report does not include your score—for that, you’ll have to pay a small fee. You can also check with your credit card company, since some (like Discover and Capital One) offer free access to scores and reports. If you discover errors, take these steps to correct errors and remove negative items from your credit report. Or, even if your credit report does not contain errors, if it’s not as great as you’d hoped, you can raise your credit score. Just keep in mind, you won’t improve your credit score overnight, which is why you should check your credit score annually—long before you get the itch to start house hunting.

How to check your credit score

You can check your own credit report—and should, because it will help you pinpoint areas for improvement. Even if you’re fairly sure you’ve never made a late payment, one in four Americans finds errors on his/her credit report, according to a 2013 Federal Trade Commission survey. Errors are common because creditors make mistakes reporting customer slip-ups. For example, although you may have never missed a payment, someone with the same name as you did—and your bank recorded the error on your account by accident.

How To Build Your Credit Score

Here are some of the best ways to improve your credit score:

- Make payments, including rent, credit cards and car loans, on time.

- Keep your spending to no more than 30% of your limit on credit cards.

- Pay down high-balance credit cards and consider balance transfers to free up credit.

- Check for any errors on your credit report and work toward fixing them.

- Shop for mortgage rates within a 30-day period. Too many spread-out inquiries can lower your score. See below for additional details.

- Work with a credit counselor or a lender to build your credit.

Lenders do a hard credit pull when you apply for a rate quote, which typically dings your credit score by five points or less. But as long as you get all your mortgage quotes within a 30-day window, the credit bureaus will count these pulls as one single inquiry. So your score won’t be dinged multiple times.

Related Articles

Sources for Your Downpayment

How to Choose the Best Mortgage Lender or Broker

How to Compare Mortgage Loan Offers

How to Get the Best Mortgage Interest Rate

What is a Good Credit Score and What Do You Need to Buy a Home?

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235