Suppose you bought a house and later discovered, to your dismay, that the stucco exterior concealed a nasty case of dry rot. Or suppose that when you fired up the furnace in the winter, you discovered a cracked heat exchanger leaking gas into your home. The best way to avoid unpleasant surprises like these is […]

Tag Archives: First-Time Home Buyers

Tips For First-Time Home Buyers

For many people, buying their first home is a rite of passage and ownership is part of the American dream. And while many excited hours are spent planning interior color schemes, choosing new furniture and dreaming of moving day, many first-time buyers spend equal amounts of time fretting the home buying process. Let’s face it, if […]

Home Owners Insurance

In the United States, most home buyers borrow money in the form of a mortgage loan, and mortgage lenders always requires that the buyer purchase homeowner’s insurance as a condition of the loan, in order to protect the bank if the home were to be destroyed Home insurance, also commonly called hazard insurance, or homeowner’s […]

Using a FHA Mortgage to Buy a Home

In recent years FHA loans have taken on renewed importance for today’s mortgage borrowers. Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if […]

Buying a Home: Commonly Overlooked Costs of Owning a Home

Prepare yourself by knowing the less-obvious costs of owning a home. Insurance, maintenance and more add up faster than you think. Buyers too often focus on a home’s list price or mortgage payment to determine what they can afford. However, the less-obvious costs associated with homeownership can affect the monthly bottom line. To help home […]

Should You Forgo the Home Inspection to Improve the Chances of Beating Out Other Buyers

If you’ve been aching to buy a home but haven’t been able to seal the deal we feel your pain. After all, pent-up demand left over from tight supply over the past two years, against the backdrop of mortgage rates remaining near historic lows, combined with continued low inventory levels and fewer homes for sale […]

Is there a period when you can change your mind after you agree to buy a home?

The short answer is NO… this assuming you don’t live in New Jersey, didn’t add an attorney review or your own “cooling-off” period clause into your contract (from the sound of it you did not… and chances are if had the seller would not have accepted your offer). Buyers and sellers often errantly believe that […]

Newlyweds: Here Are 5 Factors to Consider When Buying Your New Home

Now that the wedding is over, you and your spouse are on to the next exciting milestone: home ownership! But if you want to ensure yours is a positive home buying experience, you’ll want to consider the following before you start your home search. Neighborhood Marriage is a big transition and it may come with […]

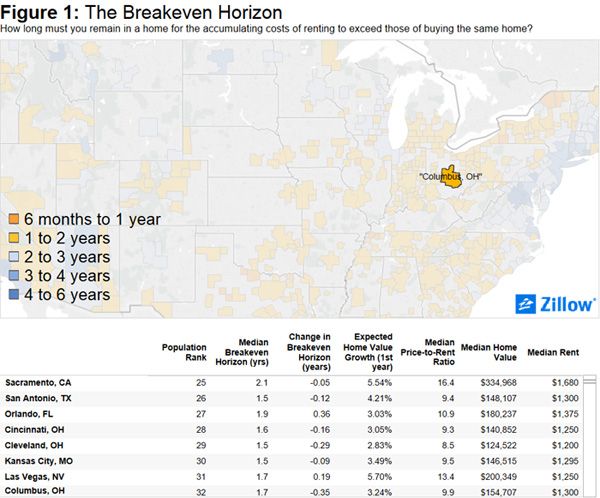

Consider the Breakeven Horizon When Evaluating the Rent/Buy Equation

With spring comes change. Time to change your wardrobe, your flower beds and, potentially, the way you live and your housing situation. As the home shopping season heats up, we’re again compelled to tackle the classic housing question: To buy or to rent? The decision whether to buy a home is difficult. It’s not just […]

Why Buyers Should Consider a Home’s School District Even If They Don’t Have Kids

In addition to providing a great education, buying a home in a good school district can result in resale advantages and offer home value protection from market fluctuations. Here’s what home buyers should know about a school district’s impact on real estate, and the benefits they can expect to incur even if they don’t have school age […]