When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Tag Archives: financing a home

Can’t Afford 20% Down? You have Options!

You want to buy your own home or perhaps you’re a move up buyer looking to climb the property ladder and purchase a larger home. But there’s just one problem: You don’t have the cash for a 20% down payment. What should you do? First, let’s assess your current situation: Are you a first-time homebuyer? Or […]

What is a Good Credit Score and What Do You Need to Buy a Home?

No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, […]

10 Things You Should NOT Do While Buying a Home

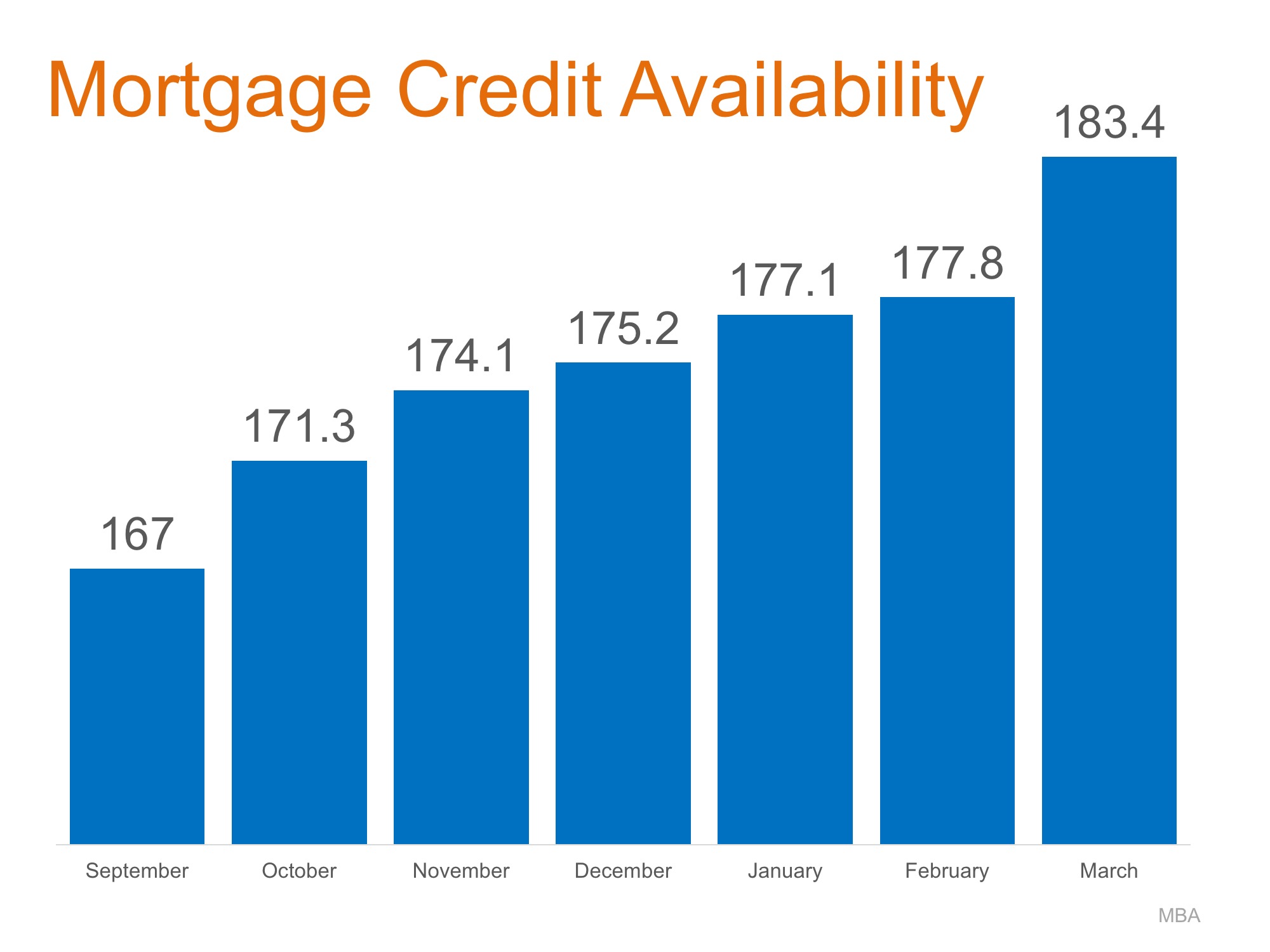

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Understanding Home Construction Loans

If you’re considering building a semi, or fully custom home one of the first things you’ll want to consider is how you’ll finance the construction of your new dream home. Construction loans are not only more difficult to qualify for, but they are also more complex and can be a bit overwhelming. It’s important that […]

How the Recent Fed Rate Hike will Impact Loan Payments

Last week, the Federal Reserve raised interest rates for the third time in 15 months. At the same time, they signaled there could be at least two additional hikes in store this year, and more over the coming several years. The good news first: That means savings rates will continue to edge higher. The bad news? […]

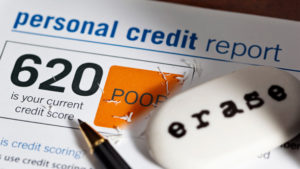

How to Improve Your Credit Score

So you’re considering buying a home and you’ve got it all planned out: a four-bedroom home in the top local school district and your favorite neighborhood including a manicured lawn, a finished basement with a theater room and—why not?—an outdoor kitchen. Slow down… one of the first steps in buying a home is to clean up your credit score, also called a […]

Self-Employed? Keys to Getting Approved for a Mortgage and Buying a Home

If you’re self-employed your office might be a built-in desk in the corner of a spare bedroom, a downtown co-working space, or the front seat of your car. The Bureau of Labor Statistics reports there are 15 million self-employed workers in America living the dream, being their own boss. Sure, it can be a struggle, […]

How the Fed Move Impacts Mortgage Interest Rates

The Federal Reserve did it — they raised the target federal funds rate a quarter point, its first boost in nearly a decade. However, this does not necessarily mean that the average rate on the 30-year fixed mortgage will be a quarter point higher as a direct result of this move. That’s not how mortgage rates […]