We need more houses. It’s going to take a long time until we have enough.

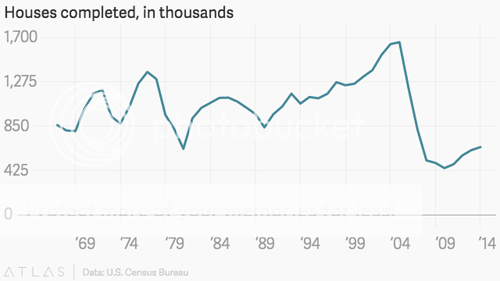

Check out what happened during and after the housing bust that began in 2008: Single-family house construction cratered. House completions have recovered a bit since 2011, but they’re barely above the depths of the 1982 recession.

Single-family home construction is currently lacking in 80 percent of measured metro areas despite steady job creation. The low activity is creating a housing shortage crisis that is curtailing affordability and threatening to hold back prospective buyers in many of the country’s largest cities, according to new research from the National Association of REALTORS®.

NAR’s study reviewed new home construction relative to job gains over a three-year period (2013-2015) in 171 metropolitan statistical areas (MSAs) throughout the U.S. to determine the markets with the greatest shortage of single-family housing starts. The findings reveal that single-family construction is startlingly underperforming in most of the U.S., with markets in the West making up half of the top 10 areas with the largest deficit of newly built homes.

Lawrence Yun, NAR chief economist, says a large swath of the country continues to be plagued by inventory shortages exasperated by critically low homebuilding activity.

“Inadequate single-family home construction since the Great Recession has had a detrimental impact on the housing market by accelerating price growth and making it very difficult for prospective buyers to find an affordable home – especially young adults,” he says. “Without the expected pick-up in building as job gains rose in recent years, new and existing inventory has shrunk, prices have shot up and affordability has eroded despite mortgage rates at or near historic lows.”

According to Yun, most of the metro areas with the biggest need for increased construction have strong appetites for buying, home-price growth that outpaces incomes and common instances where homes sell very quickly. Their healthy job markets continue to attract an influx of potential homeowners, only fueling the need for more housing.

“The limited number of listings in several markets means that many available homes are receiving multiple offers and going under contract rather quickly,” says NAR President Tom Salomone. It’s important in this situation to remain patient and not get caught up offering more than your budget allows. Find a Realtor® with experience serving clients in your desired area and rely on them to deploy a negotiation strategy that ensures success while sticking within budget.”

Looking ahead, Yun says the good news is that the ratio in many areas slightly moved downward in 2015 compared to 2014 as builders started to respond accordingly to local supply shortages. However, it’ll likely be multiple years before inventory rebounds in many of the markets because homebuilders continue to face a plethora of hurdles, including permit delays, higher construction, regulatory and labor costs, difficulty finding skilled workers and the exhausting process many smaller builders go through to obtain financing.

“Recent NAR survey data show an overwhelming consumer preference towards single-family homes, including among millennials, who are increasingly buying them in suburban areas,” concludes Yun. “A mix of new starter-homes for first-time buyers and larger homes for families looking to trade up is needed at this moment to ensure homeownership opportunities remain in reach to qualified prospective buyers at all ages and income levels.”

A tale of 2 booms

The average for the last 50 years is 1.4 million permits. But that doesn’t take population booms into account. When you look at the graph above, you can see the effect of the postwar baby boom. Building permits rose abruptly beginning in 1971, when the 1st Baby Boomers turned 25. There was a recession, and then building permits zoomed upward again and peaked in 1978, when the oldest Boomers were 32.

Now the Millennials are aging into the home buying years. The Millennials’ peak birth year was 1990, when 4.18 million children were born in the United States. In a few years, huge numbers of them will want to buy brand-new houses. They’re having children later than the Boomers did, so their peak home buying years will be later in life, too.

If we assume that the housing stock is in balance with households and needs, then we should be seeing new construction deliver the units necessary to house the new households being formed and to replace housing stock lost (lost to disaster, dilapidation or teardowns and re-development).

Last year, we saw a net increase of 1,358,000 households. … We only completed 968,000 homes. We don’t have a corresponding exact figure for housing stock loss, but a conservative estimate is that 300,000 homes were lost last year. That would mean that the net addition to the housing stock was less than half of what the increase in households warranted.

That’s 1 of the reasons that rents and home prices are rising fast in a lot of metro areas.

We need more construction to keep pace with demand, but if we don’t see it, rents and prices will continue to rise. Eventually that leads to declining affordability that could dampen job and household growth.

Not enough construction workers

The construction industry says it faces 2 main problems: A lack of buildable lots (often made worse by strict zoning and building codes) and a dearth of construction workers.

In a paper called “Where Did All the Construction Workers Go?,” a pair of Census researchers said last year that 60% of construction workers displaced by the housing bust were employed by other industries or had stopped working by 2013. Meanwhile, during the downturn, construction companies were slow to hire younger workers ages 19 to 24.

One reason for this decline could be unwillingness by construction companies to train relatively young workers relative to other industries in the economy. Another reason for this decline could be unwillingness to hire or work for short-duration contract jobs.

Whatever the reason, it means fewer young workers gained experience in the industry. That’s not going to end well.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please contact The Opland Group. We offer professional real estate advice and look forward to helping you achieve your real estate goals!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235