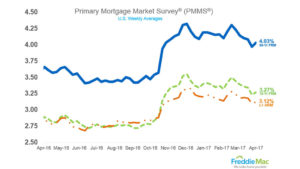

When the Federal Reserve Board raised interest rates in March, most industry professionals and “people in the know” anticipated that mortgage interest rates would begin to rise as well. Turns out that those “in the know” didn’t know as Mortgage rates for home loans have, in fact, come down a bit. Interest rates for 30 […]

Category Archives: For Buyers

What Really Makes a Property Appreciate

On average, a home’s value generally appreciates 3% to 4% per year here in Columbus and Central Ohio. This is attributed mostly to population growth and inflation. From 2011 to 2016, the national housing market was recovering from the bubble at a slightly higher speed of 6.3% per year, on average. Realtor.com®’s research team sought […]

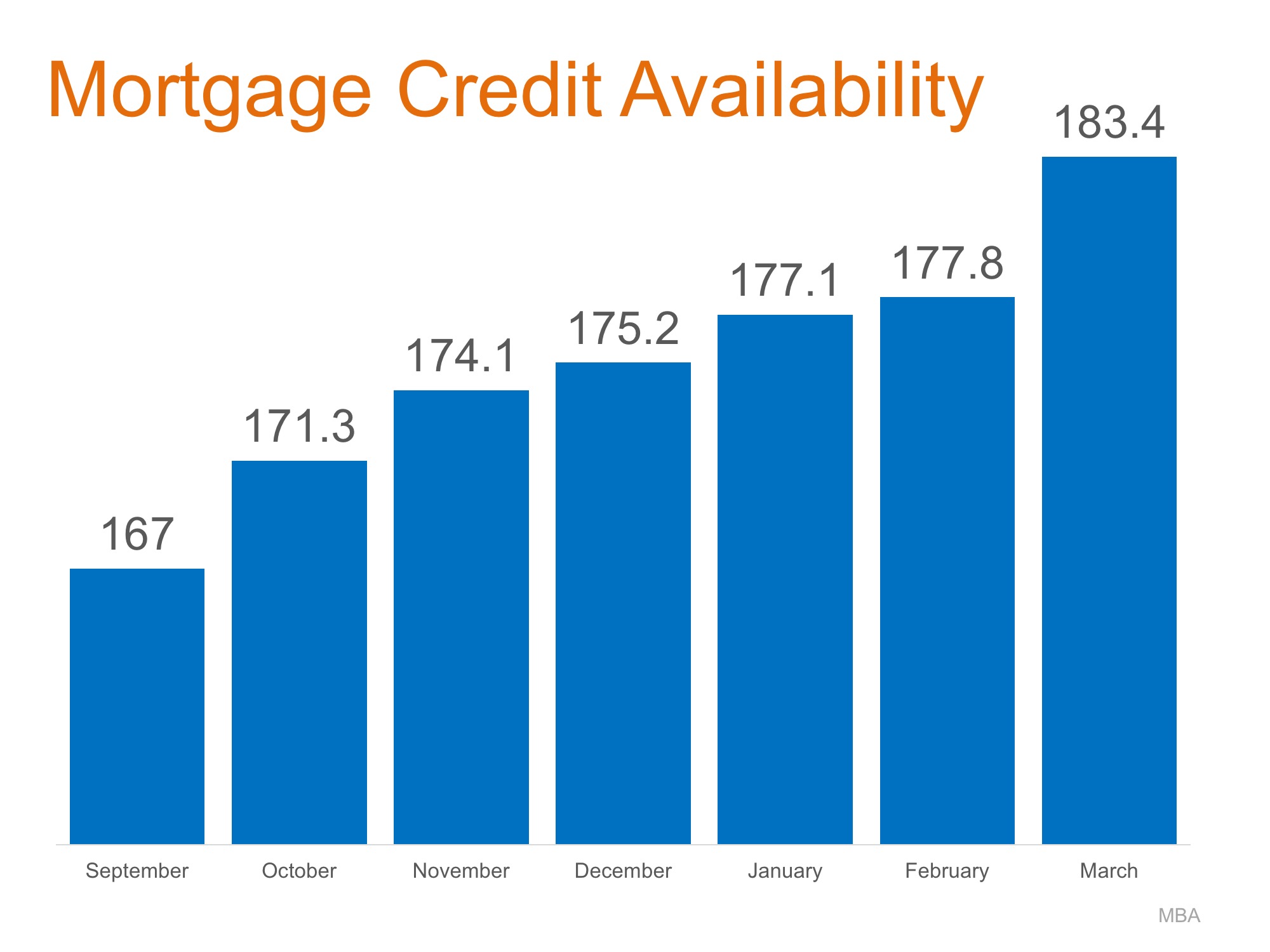

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Understanding Home Construction Loans

If you’re considering building a semi, or fully custom home one of the first things you’ll want to consider is how you’ll finance the construction of your new dream home. Construction loans are not only more difficult to qualify for, but they are also more complex and can be a bit overwhelming. It’s important that […]

Is there a period when you can change your mind after you agree to buy a home?

The short answer is NO… this assuming you don’t live in New Jersey, didn’t add an attorney review or your own “cooling-off” period clause into your contract (from the sound of it you did not… and chances are if had the seller would not have accepted your offer). Buyers and sellers often errantly believe that […]

Newlyweds: Here Are 5 Factors to Consider When Buying Your New Home

Now that the wedding is over, you and your spouse are on to the next exciting milestone: home ownership! But if you want to ensure yours is a positive home buying experience, you’ll want to consider the following before you start your home search. Neighborhood Marriage is a big transition and it may come with […]

Reasons Behind Limited Housing Inventory

As spring approaches consumers are starting to plan for 2017, especially if they want to buy or sell a home. We regularly ask our clients about their home-buying or -selling journey, what motivates them—and what’s holding them back. This time of year, our pool of prospective sellers largely shifts towards those who are just starting their research but […]

How the Recent Fed Rate Hike will Impact Loan Payments

Last week, the Federal Reserve raised interest rates for the third time in 15 months. At the same time, they signaled there could be at least two additional hikes in store this year, and more over the coming several years. The good news first: That means savings rates will continue to edge higher. The bad news? […]

Homeowners Insurance Tips

When you insure your home, you should insure your home for the total amount it would cost to rebuild your home if it were destroyed. It seems obvious but do not include the value of the land on which your home is built in this value. If you don’t have sufficient insurance, your insurance company […]

Build a New Home

New Home Construction Looking for someone to help guide you through the process of building a new home? Including everything from qualifying, interviewing, and selecting a builder, locating a lot on which to build your new home, securing a construction loan or bridge financing, etc. We can help with all of this and save you […]