When the Federal Reserve Board raised interest rates in March, most industry professionals and “people in the know” anticipated that mortgage interest rates would begin to rise as well. Turns out that those “in the know” didn’t know as Mortgage rates for home loans have, in fact, come down a bit.

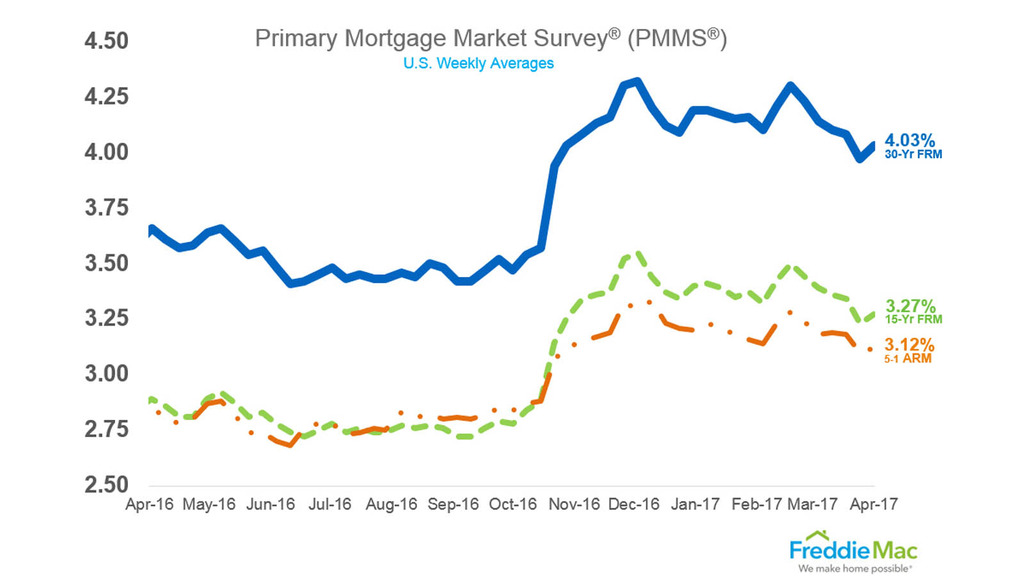

Interest rates for 30 year fixed interest rate home loans recently fell below 4% for the first time since November, 2016 according to Freddie Mac. Standing at 3.97% last week, the rate was even down 0.11% from the week before. Overall, comparing last year’s average annual rate of 4.3%, mortgage rates for 2017 are looking to be more than good at the moment.

Why? All the “smart” money urgently suggested that potential homebuyers get to buying that house in order to lock in favorable mortgage interest rates before they start climbing due to its current and anticipated hikes this year. Danielle Hale, the managing director of housing and research at the National Association of Realtors (NAR) said, “if you had an answer to why, you’d probably be making millions of dollars on Wall Street. Interest rates are really tricky to predict.” Just a small change, a fraction of a percent, can add up to hundreds of extra dollars a year, which changes the type, size and locations of homes the potential buyer could afford.

The answer to the question of why mortgage rates aren’t rising must lie elsewhere. Certainly interest rates are one factor that influences mortgage rate fluctuation but another factor is the 10 year U. S. Treasury bond market. The bond market is tied to mortgage rates. The relationship between the two is an inverse one, that is when the bond markets are up as they are now, mortgage interests rates tend to be down.

Now, the question of why is applied to the relationship of bond markets and mortgage rates. Both investment bonds and mortgages are considered to be safer, more reliable long term bets than the highly volatile stock market. Despite the stock markets meteoric rise, Robert Livingston, mortgage officer with MCS Mortgage, says that “investors are a little skeptical…they’re looking for safe ways to invest their money and they’re going back to the bond market.”

Sean Beckett, Freddie Mac’s chief economist, adds that investors are not quite as optimistic about Trump’s infrastructure plans as they were at the beginning of the year. “…people are re-evaluating and coming to the conclusion that (Trump’s promises) are going to take a lot longer than they expected.” And, instead of anticipating “massive” tax reforms along with corporate and individual tax cuts by mid 2017 as promised, tax revisions may have to realistically wait until 2018.

The best anyone can say at this point in time is that for right now, mortgage rates are dropping despite the Fed initiating interest rate hikes. But, again, who knows? Beckett sums it up best by saying that “…there’s so much uncertainty and volatility in the market that there is no way to know what rates will do next.”

In the meanwhile, NAR’s Danielle Hale says that “…it’s good news for people who are already in the market. Lower mortgage rates translate into lower monthly payments.”

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please contact The Opland Group. We offer professional real estate advice and look forward to helping you achieve your real estate goals!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Hilliard 43026 Lewis Center 43035 Marysville 43040 43041 New Albany 43054 Pickerington 43147 Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235