To understand where Central Ohio home prices are heading, we look at four key things: supply, demand, affordability and credit availability. While the first two components don’t tend to change quickly, affordability and credit availability can move very rapidly. And that’s exactly what we’re seeing now.

The upshot is that because the overwhelming number of homeowners are on fixed-rate mortgages, and because home equity is still high, most people are insulated from the coming shock. But this insulation comes with a cost, the “lock-in effect.

Current homeowners, in order to sell their home in most instances would have to take out a mortgage that might be 2-3 percent higher than their current mortgage. They’re just not going to be willing to sell their home at the lower price point that might be more affordable for buyers in the current market.

And so there’s a chance we may be heading into uncharted territory, where measures of housing activity deteriorate rapidly, even as prices stay firm.

Mortgage Rates Have Been Shocked

The average 30-year mortgage rate has increased from less than 3 percent in 2020 to 7 percent now, according to the Mortgage Bankers’ Association. That’s the highest since the early 2000s. But that sizable move has been surpassed by another key metric: the spread (or difference) between mortgage rates and benchmark interest rates as measured by the 10-year US Treasury yield.

With the economic outlook so uncertain as the Fed raises rates and with volatility in the bond market markedly higher than it used to be, many big investors have shied away from buying mortgage-backed securities and that’s helped to contribute to the higher cost of borrowing to buy a home. At the same time, the Fed has also stepped away from the market as it winds down its balance sheet.

When you have so many of what have been your larger buyers over the past couple years not as willing and able to step into the market right now (for various reasons), combined with the rate volatility we’ve seen or perhaps even exaggerated by the rate volatility we’ve seen, that can kind of lead to that gap in spreads.

Housing Affordability

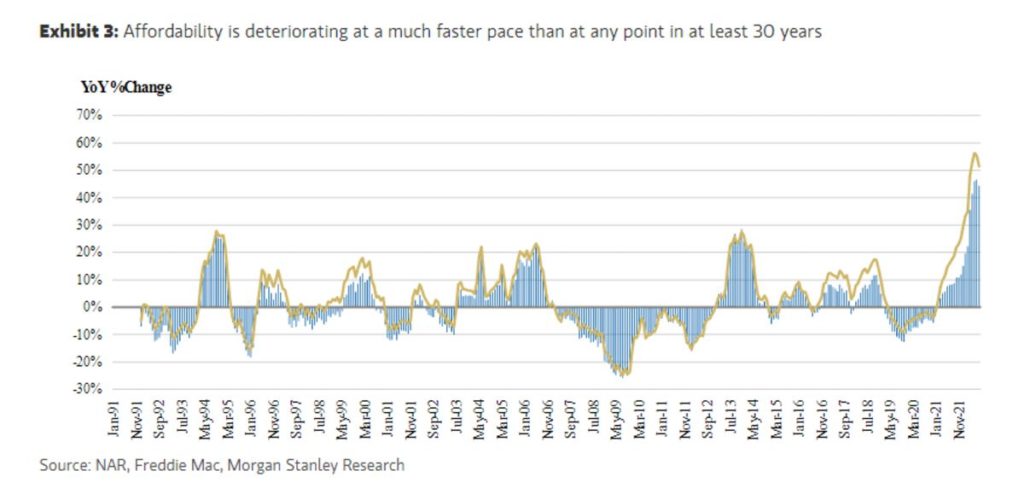

The jump in home prices combined with increasing mortgage rates means that housing affordability is now deteriorating at an unprecedented pace, especially when compared to average income. The below chart shows the year-over-year change in the monthly mortgage payment on a median- priced home as a share of average household income (in blue), plus the year-over-year change in the monthly payment (in gold).

“We’ve deteriorated incredibly substantially,” Egan says. “The GFC that year-over-year deterioration never exceeded 30%, we capped out in the twenties. But why we think home prices aren’t going to crash here, why we do think this time is different, is because the question we have to ask after affordability deterioration is whose affordability just deteriorated?

The Lock-in Effect

Homeowners who were lucky enough to secure lower rates don’t have much reason to sell into an environment of higher mortgage rates, and this is creating a ‘lock-in’ effect with fewer houses being listed for sale.

These homeowners feel a sense of being locked-in at their current homes with their lower mortgage rates and we anticipate this trend will continuing going forward for homeowners who don’t need to sell. Homeowners who are likely to sell are those who need to move due to a job relocation, the birth of a child, a divorce, etc.

Lower Inventory Levels Will Put a Floor on Home Prices

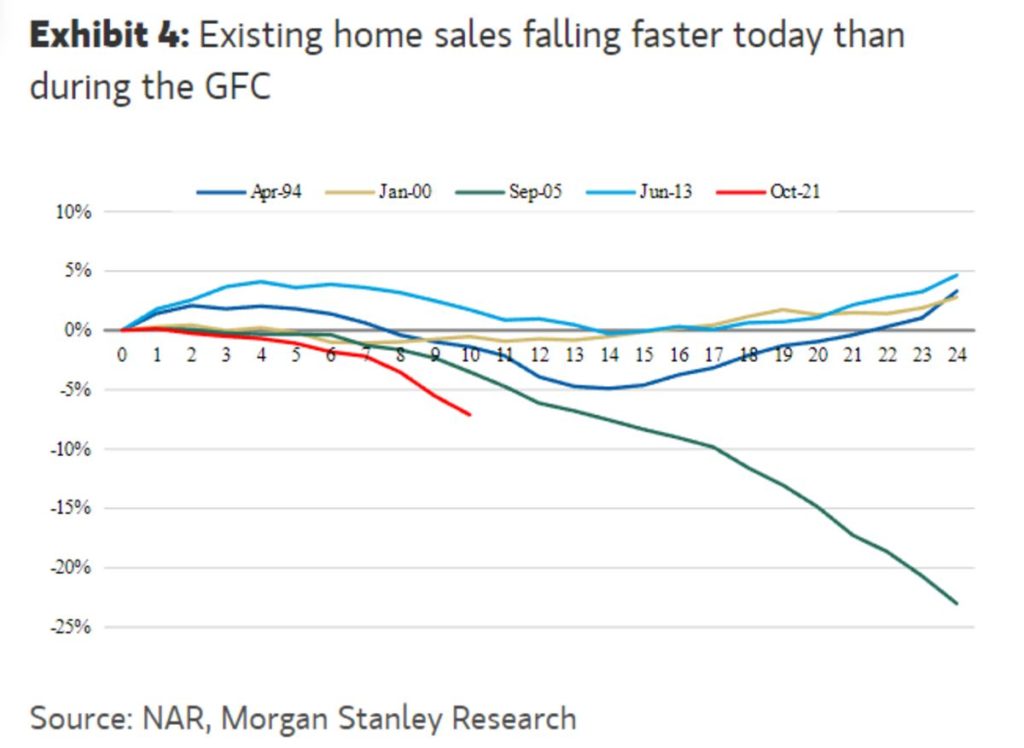

This lack of inventory resulting from so many homeowners staying in place in response to higher mortgage rates should help put a floor on prices. Sales volume is already decreasing at a faster pace than during the global financial crisis thanks to the combination of deteriorating affordability and low supply of new homes hitting the market.

If we’re not going to be selling those homes at lower prices than they were purchased, that’s going to help support home prices. But on the other side of this, it means that many sellers may elect to wait to buy a replacement until rates come down after selling their current home, which would exacerbate the decrease in sales volumes.

Central Ohio Demand for Housing Is Strong

Columbus received national recognition in September, ranking 5th on Realtor.com’s Hottest Housing Markets: In Search of Affordability List.

Realtor.com’s Market Hotness rankings take into account two aspects of the housing market: 1) market demand, as measured by views per property on Realtor.com, and 2) the pace of the market as measured by the number of days a listing remains active on Realtor.com.

The average listing price for the 20 hottest markets ticked up from last month, reaching $364,000 in September, 14.8% lower than the national median of $384,800. Central Ohio’s median sales price currently stands at just $290,000, a full $84,800 below the national median sales price!

It should come as no surprise that our city ranks as one of the hottest housing markets as not only is Columbus still affordable, but the city has been attracting new larger employers such as Intel (the construction of the first two Intel fabs will take an estimated 7,000 workers, once completed the two plants will bring 3,000 long-term high paying jobs to the region by 2025), Ford, and Pharmavite, while many of its existing employers such as Honda are doing large expansions.

Columbus is one of the nation’s fastest-growing large metropolitan areas and the fastest in the Midwest, according to the latest U.S. Census Data. Franklin County is adding roughly the equivalent of the population of Bexley (13,349 people) a year. By 2050, Columbus’ population is projected to grow by 1 million. According to a housing study conducted by the Building Industry Association (BIA) of Central Ohio, there will be an additional need for 457,597 rental and owned units to house this population surge. The organization estimates that it will require the construction of 14,000 new housing units per year to meet the demand—and the current rate, according to the BIA study, is around 8,000 per year. During the pandemic Columbus was among just 6 of the top 15 cities to gain

Bottom Line

No one wants a higher mortgage rate. Homeowners are holding on to their homes for longer because moving and finding a new home in the current market is too expensive. From a personal finance standpoint, the decision is probably wise. But from a macro perspective on the U.S. housing economy, it’s bad news.

Higher mortgage rates and lower demand for homes is helping to cool the housing market, but increasing inventory is critical. More listings and more homes on the market would have the biggest effect on alleviating competition, giving buyers more negotiating power, and reining in prices.

In a promising sign, new construction starts for homes in the U.S. are growing at a steady rate, but until current homeowners begin to venture back into the market, supply will remain constrained, and prices will likely stay relatively high.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235