Columbus Ranks 5th On Realtor.com’s Hottest, Most Afford Housing Markets

Columbus received national recognition in September as one of the hottest, and healthiest housing markets in the country. And despite rising interest rates, Central Ohio homes buyers are still reeling in benefits with home prices that are well below the national median.

The Capital City ranked fifth on Realtor.com’s hottest housing markets list for September.

It’s no surprise our midwest city ranks as one of the hottest housing markets, Columbus is still a more affordable place to live compared to many cities to our West and the East coast and has been attracting new large employers, while many existing employers are expanding their operations. Intel, Ford, Pharmavite, Honda, etc.

Realtor.com focused on cities seeing high demand and continued price growth with listing prices below the national median. According to Realtor.com, the Columbus market has a healthy number of potential buyers checking out multiple listings.

Average Sales Price Continues to Rise, But at a Slower, More Sustainable Pace

The average sales price of a home in Central Ohio jumped to $331,287 in September, up 9.9% since this time last year. Year to date the gains were even greater. People selling their homes in September saw an 11.5% sales price increase compared to what their property was worth in January. The average sales price was down over last month however, this is typical for this time of year due to seasonal factors, and the fact that fewer luxury homes tend to sell in the fall and winter which skews the numbers.

On Average, Buyers Continue to Pay Above Ask

While buyers continue to pay above ask in many markets, in total the average sales price to the last list price came in at 100.1%. On average homes sold .1% above their asking price in September however, this is an average and in most Central Ohio markets desirable homes continue to sell above ask. In the market, buyers are still paying appraisal gap coverage to secure a property but not to the degree that they were earlier in the year.

Appraisals can fall short of the higher contract price and with appraisal gap coverage, buyers agree to bring cash to closing to cover some portion of the difference between the appraised value and the contract price.

Homes Continue to Sell Quickly, but are Off Lows

In September, homes spent more time on the market. On average, it took about 18 days for a home to sell compared to 14 days last September.

Sellers will need to have a bit more patience when they list their home this fall and may need to wait a bit longer for the right buyer will benefit them. Their homes are still holding tremendous value and then some.

Inventory Levels on the Rise

New inventory on the market was tight in September across central Ohio. There was a decrease in selection by more than 14% since last September. Home buyers had just over 3,100 new homes to choose from in September.

Despite the squeeze on new inventory, the overall inventory of homes available on the market rose more than 20%. This means home buyers have a larger selection and may be able to negotiate a bit more for those homes that have been sitting on the market longer.

Where are Central Ohio Home Prices Headed?

To understand where home prices are heading, we look at four key things: Supply, demand, affordability and credit availability. While the first two components don’t tend to change quickly, affordability and credit availability can move very rapidly. And that’s exactly what we’re seeing now.

The upshot is that because the overwhelming number of homeowners are on fixed-rate mortgages, and because home equity is still high, most people are insulated from the coming shock. But this insulation comes with a cost, the “lock-in effect.

Current homeowners, in order to sell their home in most instances would have to take out a mortgage that might be 200, 250, 300 basis points higher than their current mortgage. They’re just not going to be willing to sell their home at the lower price point that might be more affordable for the first-time home buyer.

And so there’s a chance we may be heading into uncharted territory, where measures of housing activity deteriorate rapidly, even as prices stay firm.

Mortgage Rates Have Been Shocked

The average 30-year mortgage rate has increased from less than 3% in 2020 to almost 7% now, according to the Mortgage Bankers’ Association. That’s the highest since the early 2000s. But that sizable move has been surpassed by another key metric: the spread (or difference) between mortgage rates and benchmark interest rates as measured by the 10-year US Treasury yield.

With the economic outlook so uncertain as the Fed raises rates and with volatility in the bond market markedly higher than it used to be, many big investors have shied away from buying mortgage-backed securities and that’s helped to contribute to the higher cost of borrowing to buy a home. At the same time, the Fed has also stepped away from the market as it winds down its balance sheet.

“When you have so many of what have been your larger buyers over the past couple years for various reasons, not as willing and able to step into the market right now, combined with the rate volatility we’ve seen or perhaps even exaggerated by the rate volatility we’ve seen, that can kind of lead to that gap in spreads.

Housing Affordability

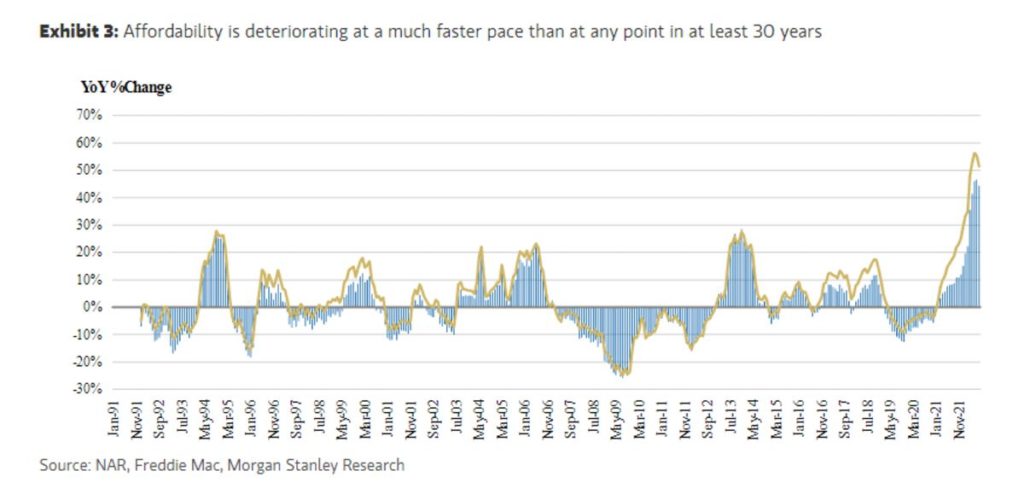

The jump in home prices combined with increasing mortgage rates means that housing affordability is now deteriorating at an unprecedented pace, especially when compared to average income. The below chart shows the year-over-year change in the monthly mortgage payment on a median- priced home as a share of average household income (in blue), plus the year-over-year change in the monthly payment (in gold).

“We’ve deteriorated incredibly substantially,” Egan says. “The GFC that year-over-year deterioration never exceeded 30%, we capped out in the twenties. But why we think home prices aren’t going to crash here, why we do think this time is different, is because the question we have to ask after affordability deterioration is whose affordability just deteriorated?

The Lock-in Effect

Homeowners who were lucky enough to secure lower rates don’t have much reason to sell into an environment of higher mortgage rates, and this is creating a ‘lock-in’ effect with fewer houses being listed for sale.

These homeowners feel a sense of being locked-in at their current homes with their lower mortgage rates and we anticipate this trend will continuing going forward for homeowners who don’t need to sell. Homeowners who are likely to sell are those who need to move due to a job relocation, the birth of a child, a divorce, etc.

Lower Inventory Levels Will Put a Floor on Home Prices

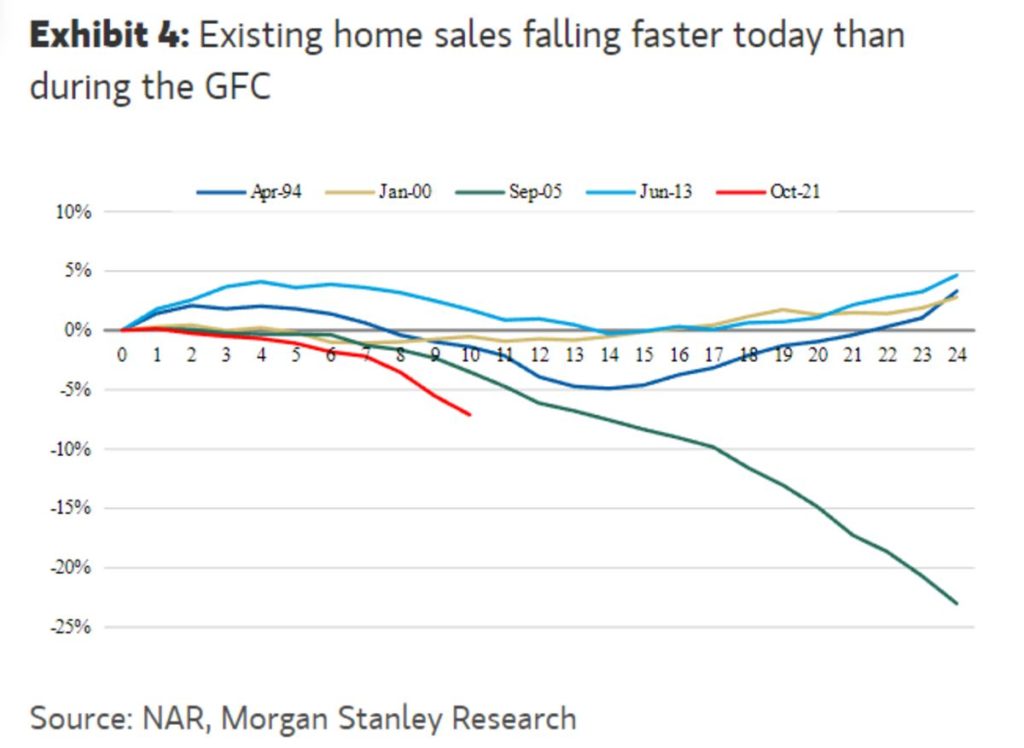

This lack of inventory resulting from so many homeowners staying in place in response to higher mortgage rates should help put a floor on prices. Sales volume is already decreasing at a faster pace than during the global financial crisis thanks to the combination of deteriorating affordability and low supply of new homes hitting the market.

If we’re not going to be selling those homes at lower prices than they were purchased, that’s going to help support home prices. But on the other side of this, it means that many sellers may elect to wait to buy a replacement until rates come down after selling their current home, which would exacerbate the decrease in sales volumes.

September 2022 Housing Report

All housing reports

September 2022 Home Stats

- Closed Transactions – 2,858 – DOWN 11.1%

- Pending Contracts – 2,917 – DOWN 17.9%

- Inventory for Sale – 3,806 – UP 8.07%

- New Listings – 3,123 – DOWN 9.22%

- Days on Market – 18 – UP 16.7%

- Average Sales Price – $331,287 – DOWN 1.97%

Bottom Line

If you’re interested in selling your Central Ohio home we’d encourage you to give us a call so we can show you the market conditions in your neighborhood and help you to get the most exposure and the most money for your home!