No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, […]

Tag Archives: Mortgage Interest Rate

Mortgage Rates: Expected to Rise but Steady For Now

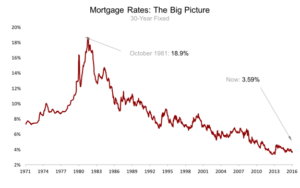

Mortgage rates held near their recent lows this week, with 30-year, fixed-rate loans averaging 3.59%. Last week, the average rate was 3.58%. A year ago it was 3.65%, according to Freddie Mac. Policymakers at the Fed raised short-term interest rates in December, causing people to worry that mortgage rates would rise, too. Thus far they […]

How the Fed Move Impacts Mortgage Interest Rates

The Federal Reserve did it — they raised the target federal funds rate a quarter point, its first boost in nearly a decade. However, this does not necessarily mean that the average rate on the 30-year fixed mortgage will be a quarter point higher as a direct result of this move. That’s not how mortgage rates […]

Mortgage Rates Move from Dirt Cheap, to Cheap

The same home you considered buying a year ago with a $200,000 mortgage would now cost about $90 more in interest payments per month, or about $1,080 per year, given the rise in mortgage rates since last year. But let’s put this increase into perspective – and take the long view. One thing seems certain: […]

How to Get the Best Mortgage Interest Rate

Mortgage lenders adjust the rates they charge borrowers based on perceptions of risk, borrowers who can demonstrate to the lender they are a low-risk are those most likely to qualify for a rate that matches those seen in all the advertisements or headlines. The rates quoted by Freddie Mac and others are averages drawn from […]