When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Tag Archives: Home Taxes & Financing

Can’t Afford 20% Down? You have Options!

You want to buy your own home or perhaps you’re a move up buyer looking to climb the property ladder and purchase a larger home. But there’s just one problem: You don’t have the cash for a 20% down payment. What should you do? First, let’s assess your current situation: Are you a first-time homebuyer? Or […]

Avoid Paying Taxes When You Sell Your Home

With the right knowledge, information, and patience, you can completely avoid paying taxes on the gain from the sale of your home (or a rental property or vacation home) — stick the gain in your pocket and thumb your nose at Uncle Sam. How It Works Under current tax rules you are allowed to sell a […]

Using a FHA Mortgage to Buy a Home

In recent years FHA loans have taken on renewed importance for today’s mortgage borrowers. Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if […]

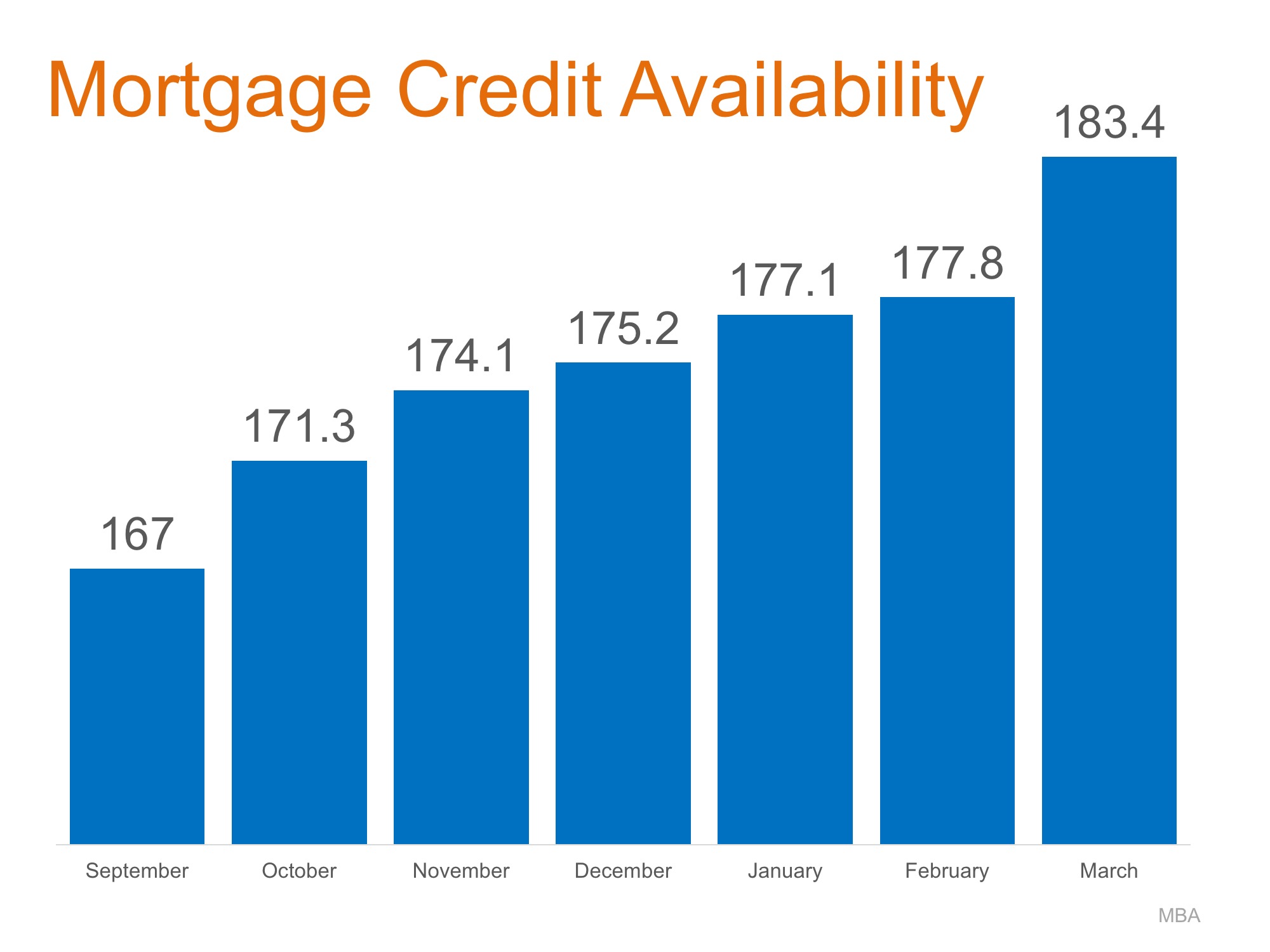

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Understanding Home Construction Loans

If you’re considering building a semi, or fully custom home one of the first things you’ll want to consider is how you’ll finance the construction of your new dream home. Construction loans are not only more difficult to qualify for, but they are also more complex and can be a bit overwhelming. It’s important that […]

How Can You Use Your Home’s Equity?

You’ve no doubt heard that homeownership is a great investment. However, few homeowner’s fully understand why and how and this is especially true when it comes to home equity. For most their home is our largest financial asset, in most cases making up over half of their net worth. But how can you use your […]

4 Steps to Take Before Borrowing From Your Home’s Equity

With the housing market in full recovery mode and home values on the rise you might be considering tapping some of the equity in your home. Those considering this option should do their homework first. The time you spend now could save you heartache (and plenty of money) in the future. Take these four steps before signing […]

How to Improve Your Credit Score

So you’re considering buying a home and you’ve got it all planned out: a four-bedroom home in the top local school district and your favorite neighborhood including a manicured lawn, a finished basement with a theater room and—why not?—an outdoor kitchen. Slow down… one of the first steps in buying a home is to clean up your credit score, also called a […]

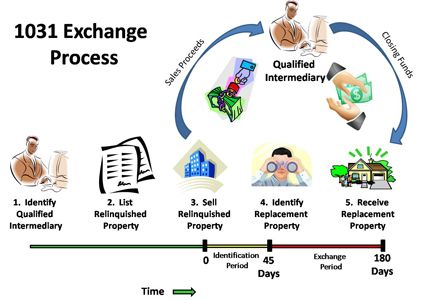

Consider a 1031 Exchange When Buying and Selling an Investment Property

A strong real estate market brings opportunities for savvy investors, and over the past few years, Columbus and Central Ohio has proved to be just that. Low interest rates are fueling a significant number of large scale new developments throughout the city, as well as re-development in other parts of town. This combined with these low rates, and strong […]