A strong real estate market brings opportunities for savvy investors, and over the past few years, Columbus and Central Ohio has proved to be just that.

Low interest rates are fueling a significant number of large scale new developments throughout the city, as well as re-development in other parts of town. This combined with these low rates, and strong demand for housing has created a influx of new investment opportunities. While some investors will simply add real estate to their investment portfolios and hope the market keeps rising, with a little creativity and careful planning real estate investors can capitalize on a completely different type of opportunity—not purchasing property, but exchanging it.

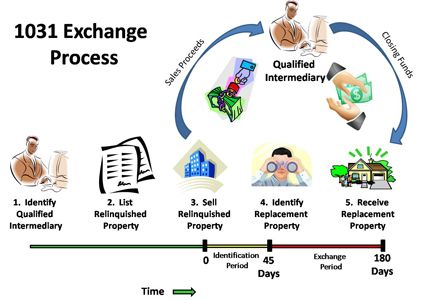

A person or company is permitted to sell real estate and use the proceeds to purchase new property, all without paying tax on the proceeds until the new holding is eventually sold. Executed correctly, this type of transaction gives investors a remarkable amount of flexibility in deciding when and how they will pay taxes on the real estate they buy and sell. Referred to as a 1031 Exchange, this rule derives it’s name from the section of the tax code in which it is found. 1031 Exchanges are more complex than the standard real estate transaction and require expert advice from attorneys and tax professionals. But, parties should keep the provision in mind when planning an investment strategy.

An example of a situation that might warrant a 1031 Exchange would be the following: imagine that you own a condo and are interested in selling this property to trade up to a larger four unit apartment building. If you sell the condo at a profit and use the proceeds to buy the four unit apartment building (or some other real estate), you can accomplish three things in one transaction—i.e., selling the condo today at a profitable level, acquiring a new investment, and deferring tax liabilities until you decide to resell the replacement property.

Capital Gains are taxable income from selling an asset for more than its basis. Or, in English: Sales Price – Your Cost = Capital Gain.

Your Capital Gain is generally taxed based on whether it is Short Term or Long Term.

Gains that are Short Term are assets that were held for 1 year or less. This gain is taxed as ordinary income, so referring to your income tax bracket should give you an idea of what percentage you’ll owe Uncle Sam.

Gains that are Long Term are assets that are held for 1 year and 1 day or more. This gain is taxed at 15% if you are an individual making less than $400K or a couple making less than $450K. If you (or you and your spouse) are above that threshold, your gain will be taxed at 20%.

A tax-deferred (1031) exchange allows an owner of investment property to exchange that property for new property without incurring income tax on the Capital Gain.

To be eligible under §1031, a taxpayer must meet the following:

- The property given and the property received must be for business or investment purposes (not your primary residence).

- The property given and the property received must be “like-kind”, meaning the same type. (i.e. a residential lot for a residential lot = Like-Kind, they do not have to be of the same quality).

- The transaction is a mutual transfer, and is not a sale or re-investment.

A section 1031 transaction is also known as a “like-kind exchange,” but there is no requirement to actually swap property with another party. Instead, the new property can be purchased from almost any source so long as the transaction is completed within 180 days of selling the old property. It’s also important to note that all potential replacement properties must be identified during the first 45 days after the sale.

This is where working with a good real estate professional can be invaluable. Investors need an agent with the industry connections and market awareness who will help identify replacement properties, negotiate with sellers, and close the deal within the allotted time.

If you’re considering a 1031-type exchange transaction, please feel free to contact me any time – I would be happy to discuss any questions with you.

Jason Opland, REALTOR® | Better Homes and Gardens Commercial | 614 332 6984 | jasonopland@msn.com

**Please note this in no way represents tax advice – please consult with your attorney and CPA regarding details about your specific situation.