An earnest money deposit is a specific form of security deposit made in real estate transactions to demonstrate that the applicant is serious and willing to demonstrate an earnest of good faith about wanting to complete the transaction. Earnest money deposits are one of the most misunderstood parts of the home-buying process. Depending on where you live, you can expect to […]

Tag Archives: buying a home

Where are Home Values Headed as Interest Rates Rise

After years of speculation about mortgage interest rates, the Federal Reserve has begun increasing the Fed Funds Rate. The Fed Funds rate sets the cost of borrowing for the banks, and consequently the cost of mortgages for homebuyers. With additional moves at hand, there is concern that more expensive mortgage rates could hamper the housing […]

How to Choose the Best Mortgage Lender or Broker

Good News for Buyers… More Seller’s Report They’re Ready to Sell

Many homeowners have been reluctant to list their homes for sale, some by choice, some for fear of being able to find a replacement home and being able to time their transactions, while others express concern about the ability to afford a new home. If you’re one of these owners call us today to learn […]

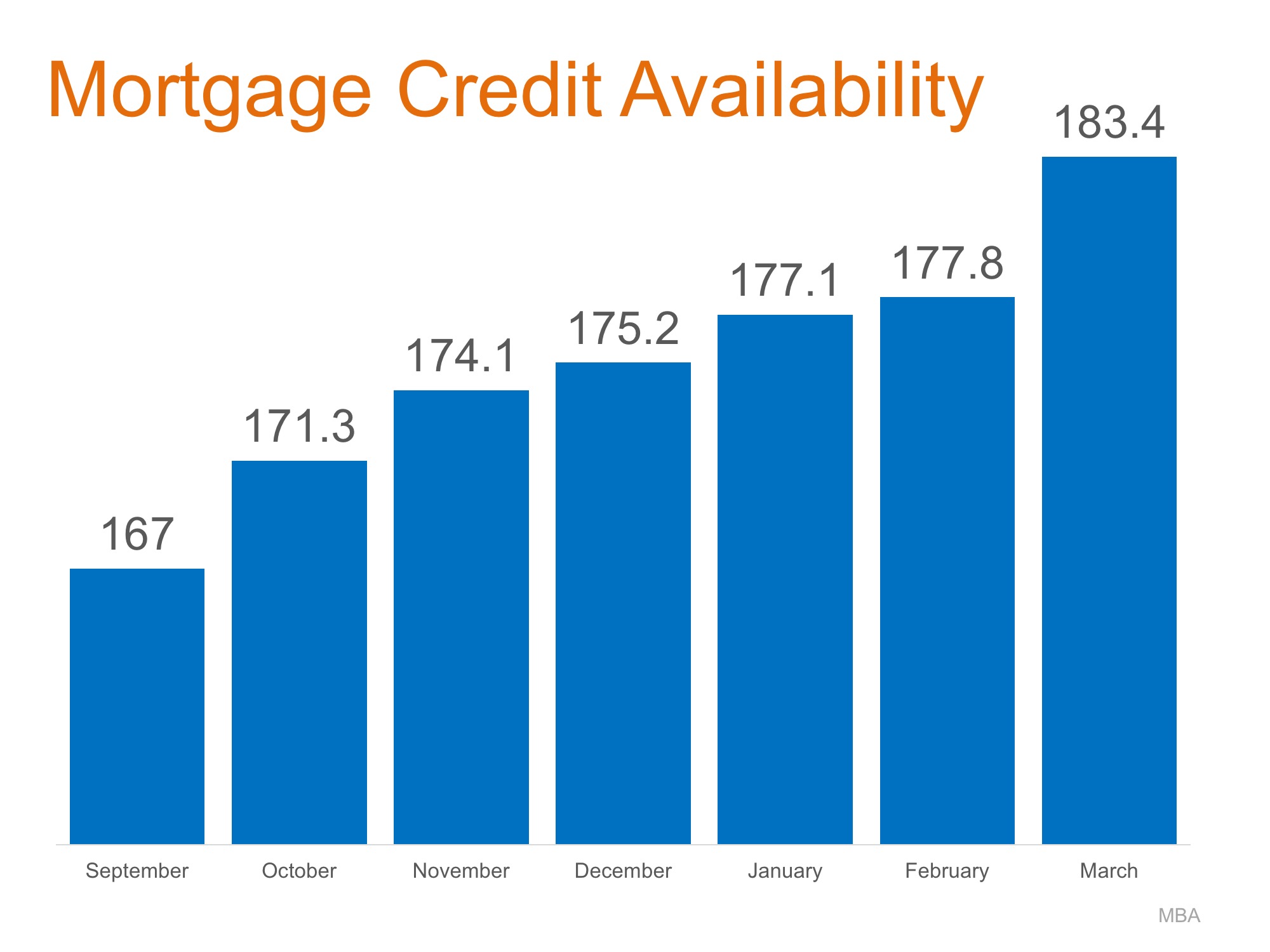

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Is there a period when you can change your mind after you agree to buy a home?

The short answer is NO… this assuming you don’t live in New Jersey, didn’t add an attorney review or your own “cooling-off” period clause into your contract (from the sound of it you did not… and chances are if had the seller would not have accepted your offer). Buyers and sellers often errantly believe that […]

Newlyweds: Here Are 5 Factors to Consider When Buying Your New Home

Now that the wedding is over, you and your spouse are on to the next exciting milestone: home ownership! But if you want to ensure yours is a positive home buying experience, you’ll want to consider the following before you start your home search. Neighborhood Marriage is a big transition and it may come with […]

Reasons Behind Limited Housing Inventory

As spring approaches consumers are starting to plan for 2017, especially if they want to buy or sell a home. We regularly ask our clients about their home-buying or -selling journey, what motivates them—and what’s holding them back. This time of year, our pool of prospective sellers largely shifts towards those who are just starting their research but […]

How the Recent Fed Rate Hike will Impact Loan Payments

Last week, the Federal Reserve raised interest rates for the third time in 15 months. At the same time, they signaled there could be at least two additional hikes in store this year, and more over the coming several years. The good news first: That means savings rates will continue to edge higher. The bad news? […]

Homeowners Insurance Tips

When you insure your home, you should insure your home for the total amount it would cost to rebuild your home if it were destroyed. It seems obvious but do not include the value of the land on which your home is built in this value. If you don’t have sufficient insurance, your insurance company […]