Looking to buy in a community with an HOA? Here’s what you need to know about your membership options. So you’ve found your dream home, but it happens to be in a neighborhood with a Homeowners Association, commonly known as an HOA. There are plenty of rules and regulations you’ll have to follow as a homeowner […]

Tag Archives: buying a home

Renting vs. Buying

Many renters feel buying a home is an impossible dream. But consider this: A landlord expects to make a profit after paying the mortgage, taxes, insurance, repairs and other expenses. The landlord’s only income for the rental property is the rent paid by the tenants. As time goes on, and the value of the property […]

Home Warranties Explained

While buying a home remains one of the biggest investments a person will make in his or her life, there’s always a lingering fear that something may go wrong soon after the purchase. Though home inspections may catch most of these problems before they occur, what happens if a major system or appliance goes haywire […]

Buying a Home – Things to Do After Closing

So you finally got through all of the loan documents, closed on your property, and got the keys to your new house… what do you do next? The home buying process can be an intensive and overwhelming experience and in a continued effort to be of service to our clients we’ve prepared a short list to ease your transition […]

Understanding Closing Costs and How to Reduce Them When Purchasing or Refinancing a Home

When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Can’t Afford 20% Down? You have Options!

You want to buy your own home or perhaps you’re a move up buyer looking to climb the property ladder and purchase a larger home. But there’s just one problem: You don’t have the cash for a 20% down payment. What should you do? First, let’s assess your current situation: Are you a first-time homebuyer? Or […]

Adjustable Rate Mortgages (ARMs) Explained

Adjustable Rate Mortgages (ARMs) With an adjustable rate mortgage, the interest rate and monthly payments varies according to a specific benchmark. The initial interest rate is usually fixed for a period of time after which it is reset periodically. The interest rate paid by the borrower will be based on the benchmark plus an additional spread, called an ARM […]

Understanding Real Estate Appraisals

Understanding how appraisals work will help you achieve a quick and profitable refinance or sale. When you refinance or sell your home, the lender involved will insist that an appraisal be performed. An appraisal is the process of valuing real property and is simply an opinion of the market value of your home based on […]

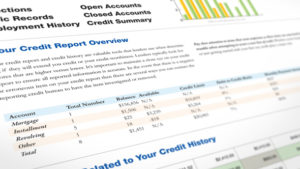

What is a Good Credit Score and What Do You Need to Buy a Home?

No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, […]