With the housing market in full recovery mode and home values on the rise you might be considering tapping some of the equity in your home. Those considering this option should do their homework first. The time you spend now could save you heartache (and plenty of money) in the future. Take these four steps before signing […]

Category Archives: Home Loans & Mortgages

How to Improve Your Credit Score

So you’re considering buying a home and you’ve got it all planned out: a four-bedroom home in the top local school district and your favorite neighborhood including a manicured lawn, a finished basement with a theater room and—why not?—an outdoor kitchen. Slow down… one of the first steps in buying a home is to clean up your credit score, also called a […]

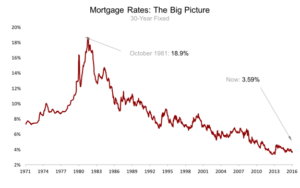

Mortgage Rates: Expected to Rise but Steady For Now

Mortgage rates held near their recent lows this week, with 30-year, fixed-rate loans averaging 3.59%. Last week, the average rate was 3.58%. A year ago it was 3.65%, according to Freddie Mac. Policymakers at the Fed raised short-term interest rates in December, causing people to worry that mortgage rates would rise, too. Thus far they […]

How the Fed Move Impacts Mortgage Interest Rates

The Federal Reserve did it — they raised the target federal funds rate a quarter point, its first boost in nearly a decade. However, this does not necessarily mean that the average rate on the 30-year fixed mortgage will be a quarter point higher as a direct result of this move. That’s not how mortgage rates […]

Loan Estimate and Closing Disclosure

A Loan Estimate (LE) is a form that lists basic information about the terms of a mortgage loan for which you’ve applied. The idea behind the Loan Estimate (like the Good Faith Estimate before it) is to get critical information about the loan into the hands of the borrower as early as possible so that you as […]

What is a Good Faith Estimate (GFE)

A Good Faith Estimate (GFE) is a form that lists basic information about the terms of a mortgage loan for which you’ve applied. The GFE includes the estimated costs you’ll have to pay for the home loan. The Good Faith Estimate provides you with basic information about the loan including the Annual Percentage Rate (APR), […]

FHA Payoff Rule To Be Revised

Can you be charged interest on your mortgage even after you’ve paid it off in full? Can the meter keep running when you owe the bank nothing — your principal balance is zero? Surprise! Much to the chagrin of large numbers of home sellers and refinancers, the answer for years has been yes. If your […]

FHA Reduces Waiting Period for Borrowers Who Experienced a Short Sale, Foreclosure or Deed-In-Lieu

The Federal Housing Administration (FHA) is allowing borrowers who went through a bankruptcy, foreclosure, deed-in-lieu, or short sale to re-enter the market and purchase a home using an FHA insured mortgage in as little as 12 months, according to a mortgage letter released Friday 8/23/13. Currently borrowers who experienced a foreclosure, deed-in-lieu, or short sale must […]

How Long Does it Take to Close on a Home Purchase

How long does it take to close on a home purchase? If you are a cash buyer theoretically you can close as soon as you like. If you intend to finance your purchase with a mortgage the process can take a bit longer. Average Purchase Closing Time : 30 Days Nationwide, as demand and competition for homes for […]

Lenders Loosening Mortgage Underwriting Standards as Rates Rise

LendingTree’s monthly Credit Accessibility Report shows the average accessibility score for U.S. borrowers rose from 103 to 106 between July and August, indicating that borrowers had easier access to mortgage credit making it easier for homebuyers to qualify for a mortgage. The Credit Accessibility score is benchmarked at 100, using data from the full year […]