A new program allows employers to help workers’ down payment on a home, similar to how companies contribute to a 401(k). HomeFundMe, a Fannie Mae and Freddie Mac-approved down payment crowdfunding platform, allows borrowers to crowdfund their down payment from several sources, including their employer. CMG Financial, a mortgage banking firm, created the HomeFundMe program. Employers can […]

Category Archives: Home Loans & Mortgages

How to Choose the Best Mortgage Lender or Broker

What’s My Home Worth? Real Estate Valuation Tools

This article explains the four most common valuation methods used for real estate and property transactions, including how and when they are used. It’s important to note that the methods below are not necessarily mutually exclusive. Homeowners, lenders, mortgage servicers, investors, and other professionals use one or more of these valuation methods, depending on circumstances […]

Why are Mortgage Interest Rates Trending Down?

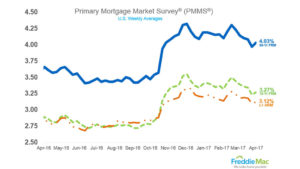

When the Federal Reserve Board raised interest rates in March, most industry professionals and “people in the know” anticipated that mortgage interest rates would begin to rise as well. Turns out that those “in the know” didn’t know as Mortgage rates for home loans have, in fact, come down a bit. Interest rates for 30 […]

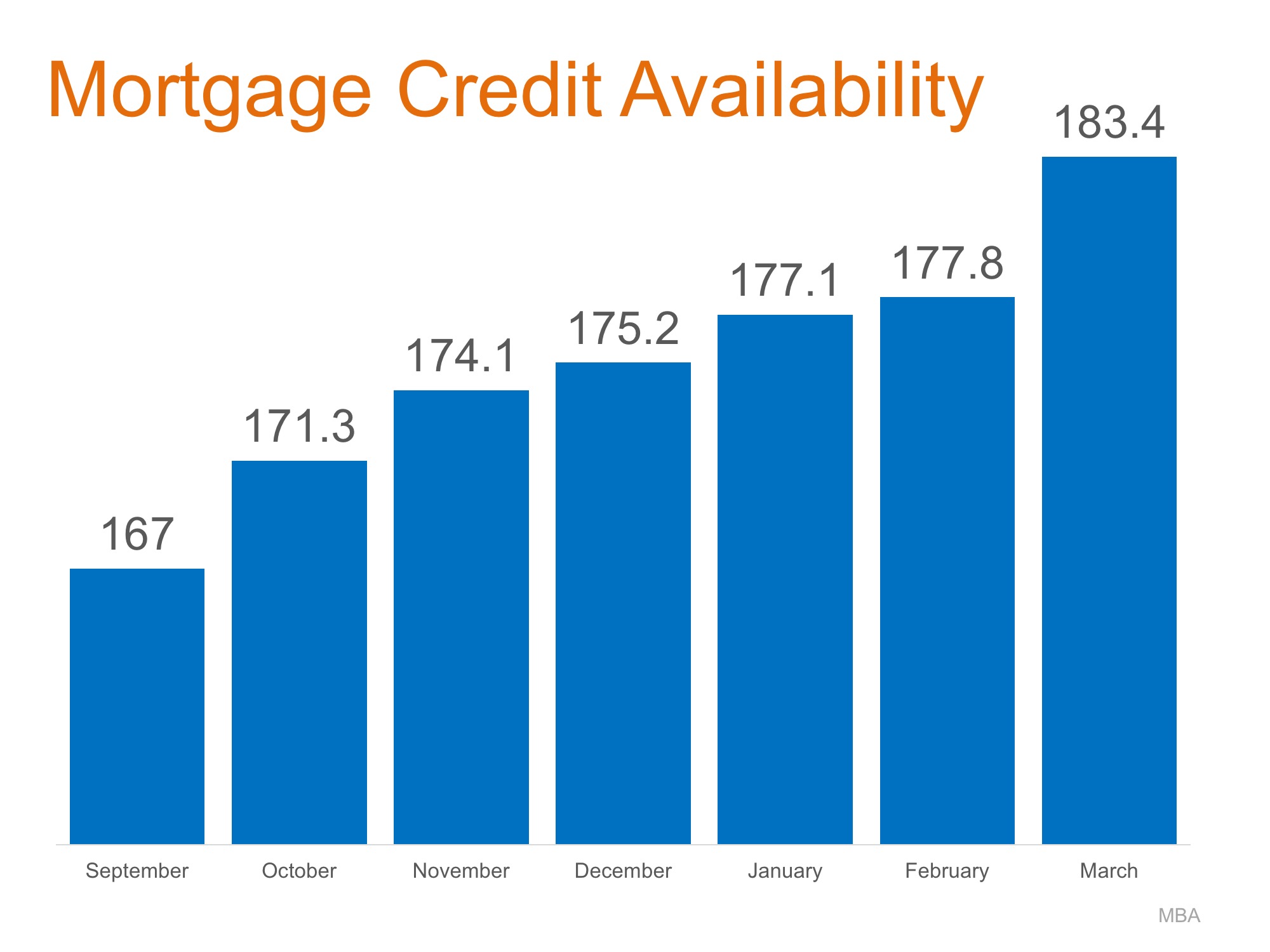

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Understanding Home Construction Loans

If you’re considering building a semi, or fully custom home one of the first things you’ll want to consider is how you’ll finance the construction of your new dream home. Construction loans are not only more difficult to qualify for, but they are also more complex and can be a bit overwhelming. It’s important that […]

How Can You Use Your Home’s Equity?

You’ve no doubt heard that homeownership is a great investment. However, few homeowner’s fully understand why and how and this is especially true when it comes to home equity. For most their home is our largest financial asset, in most cases making up over half of their net worth. But how can you use your […]

How the Recent Fed Rate Hike will Impact Loan Payments

Last week, the Federal Reserve raised interest rates for the third time in 15 months. At the same time, they signaled there could be at least two additional hikes in store this year, and more over the coming several years. The good news first: That means savings rates will continue to edge higher. The bad news? […]

What is a Loan Modification

Whether it’s called a loan modification, mortgage modification, restructuring, or workout plan, it’s when a borrower who is facing great financial hardship, having difficulty making their mortgage payments and is facing foreclosure, works with their lender to change the terms of their mortgage loan to make it affordable. The workout plan varies by lender, but […]

Understanding Credit Scores

Home buyers who are seeking a loan find out early-on that their credit scores play an important part in the loan approval process and in determining the interest rate that a lender offers. What is a credit score? When you apply for credit whether for a credit card, a car loan, or a mortgage, lenders […]