While FHA FICO score requirements have not changed during the COVID Crisis, some FHA mortgage lenders have increased requirements following the uncertainty caused by the pandemic.

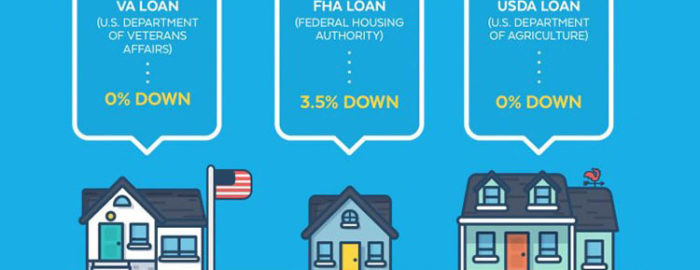

For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent.

If your credit score is below 580, however, you aren’t necessarily excluded from FHA loan eligibility. Applicants with lower credit scores will have to put down a 10 percent down payment if they want to qualify for a loan.

So if you’re planning to buy a house, and your credit score doesn’t meet the minimum, you should weigh the advantages and disadvantages of putting down a larger down payment or using those funds to try and improve your credit score first.

Using a FHA Mortgage to Buy a Home

Can You Win Offers with VA and FHA Loans?

First-time buyers without extra cash are having a hard time competing in this hot sellers’ market.

On many suburban listings in sought after communities we are seeing offers as high as 10% above list price. While most of these properties will not appraise for the agreed contract price, to compete many buyers are offering appraisal gap coverage to support a defined portion of any potential appraisal shortfall.

Buyers with VA or FHA loans, buyers not having the extra cash to offer, and buyers asking for seller paid closing costs are at a severe disadvantage. In fact in many markets and price points, it is almost impossible to win against cash offers or conventional financing.

Can You Buy Homes Without Competition?

Not every listing sells in just a few days with multiple offers. Some homes have been listed on the MLS for weeks, even months.

They don’t sell for one of two reasons:

- they’re overpriced and/or

- they’re not updated.

While it may be hard to convince an “overpriced” seller to accept lower offers initially, these sellers typically eventually realize they’ve overpriced their home and adjust the price. After all, they have to pay a mortgage, property taxes, insurance, and utilities. It adds up. And, when the time is right these sellers do typically end up accepting a lower offer.

Our Recommendation for VA & FHA Buyers

Consider Columbus and Central Ohio new construction (new builds), or look for homes that have been listed for more than 30 days and need updating.

New homes are typically more expensive (not unlike purchase a new car, you pay a bit of a premium for purchase new home in which everything is well, new) as not only has the cost of everything that goes into them continued to rise (land, permitting, materials, and labor), but also they feature energy efficient materials that help to reduce their costs during their period of ownership. That said, many of the larger builders are offering to buy down rates, pay closing costs, and/or provide some free options which all help to reduce monthly payments on these new homes.

You should also consider homes that have lingered on the market for 30 days or more as there is a good chance you can buy such a home at a fair price without competition.

Be prepared to do some painting and/or remodeling yourself, or to hire a contractor after you close. If you need recommendations for good remodelers / contractors we are happy to assist.

With this strategy you will gain instant equity and you’ll avoid overpaying for your home like other buyers who get caught up in a bidding war.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please contact The Opland Group. We offer professional real estate advice and look forward to helping you achieve your real estate goals! Call or text us at 614.332.6984.