Inventory on the rise in central Ohio

The inventory of homes for sale in central Ohio in July climbed to 5,184, a 5.5% increase over June, although still down 5.7% from July 2017. This is the highest inventory of homes listed for sale since last fall according to the Columbus REALTORS® Multiple Listing Service (MLS).

The slight increase in inventory is encouraging for buyers. Buyers are still actively house hunting with both interest rates and home prices continuing to rise. Now is the time for serious buyers to partner with a REALTOR® to get their proverbial foot in the door.

The increase in inventory is thanks to the 3,843 homes and condos that were added to the market in July. July’s new listings were 0.4% more than the same month a year ago, although down 5.6% from June. A downward trend that is quite typically.

Central Ohio sellers recognize it continues to be an excellent time to put their home on the market, with the continued demand and exceptional appreciation, sellers are reaping the benefits of homeownership.

There were 3,208 homes and condos sold in July, which is 2.3% more than July 2017, although a slight dip of 3.8% from the previous month.

Sales prices continue to rise which reflects the strength of our real estate market and buyers’ desire to achieve the American dream of homeownership.

Across the central Ohio market, homes that sold during July were on the market for an average of 23 days, unchanged from June, with an average sales price of $238,655. The average sales price is 5.2% higher than the same month last year, but 2.5% below June. Median sales price was $205,000, up 6.0% from a year ago.

The June dip is the result of fewer home sales in the upper tier of the market, as opposed to buyers paying less for homes. The luxury market was the first tier of the market to recover and demand in this portion of the market has started to slow this as mortgage interest rates have begun to rise.

The economy is solidly advancing. The anticipated growth rate of 4-5% in the second quarter is remarkable. For the year, the GDP will exceed 3% for the first time since 2005. Employment, like-wise is strong with 5 million net new jobs over the past two years, pushing the unemployment rate down to 3.8%, the lowest rate in 50 years. Wages are up too, by 2.8% over the last 12 months.

There is more good news. Despite recent volatility, the stock market has been close to an all-time high, helping advance combined wealth in the US past the $100 trillion mark for the first time. Across the country, the median home price has risen 40% over the last five years and continues to climb.

Despite all of this housing inventory levels are low which is containing home sales. The other issue is declining affordability. Renters feel squeezed out of the market as home prices are rising faster than incomes and interest rates keep climbing. That said, renters are also feeling the squeeze as rents in Columbus are rising

Real estate data firm RealPage Inc. pegged Columbus one of 10 markets in the United States where rent rose the fastest in the second quarter of the year, with annual rent here rising by 3.5%, well above the national rent growth of 2.3%. HotPads, an affiliate of Zillow, indicated in its own report that rents in Central Ohio are growing fastest in one- and two-bedroom rentals. Renters looking at a one-bedroom rental can expect to pay an average of $975 a month, which is up 4% from a year ago.

Two-bedroom rentals here are up 3.9% to an average of $1,105 a month and three-bedroom rentals are up 3.6 percent to $1,350 a month. That compares to a slower national median rent growth of 2.5% across the board.

New apartment construction tends to focus on studios and one-bedrooms, so the additional supply of smaller units has eased price pressures in that market segment in those area with lighter demand. That said, renters looking for an apartment or home – should expect faster rent growth in the years ahead this as mortgage interest rates continue to rise resulting in higher mortgage payments and shifting the Rent vs Buy Equation (Is It Better to Rent or Buy?) allowing landlords to more aggressively increase rents as the alternative of purchasing a home becomes more expensive.

* TIP – Even though demand generally holds up through late summer, by August or September, there’s a tendency for landlords to position rents more conservatively in order to fill as many units as possible before the seasonal slowdown in leasing begins.

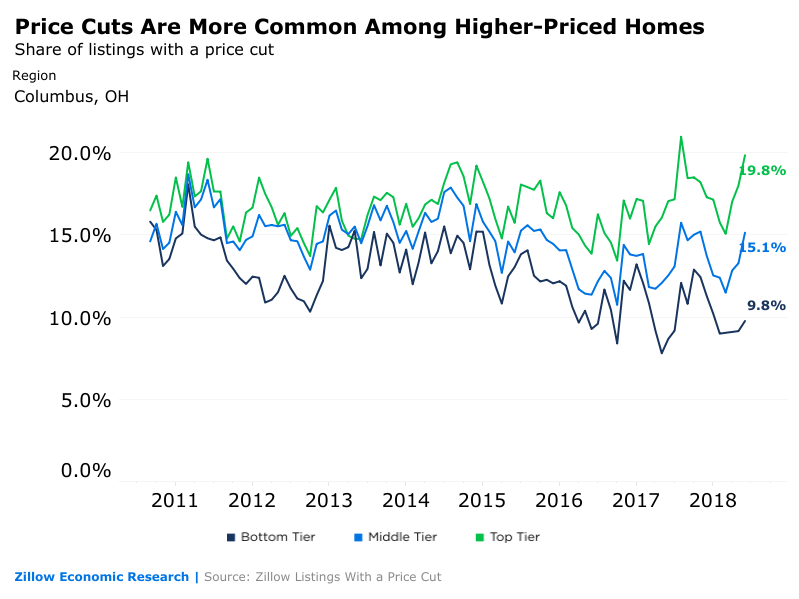

Back to housing, there’s an early indicator that the market may be starting to shift. At the start of summer, 14.2% of listings nationwide had their prices reduced, according to a new report by Zillow. This was especially pronounced in the upper tier of the market. At the beginning of the year, 13% had cuts, and at the close of 2016, 11.7% were lowered. The increase between January and June is the largest on record in the report, and doubled the jump in the same six months in 2017.

Overall increases in the share of homes with a price cut are focused on properties in the upper reaches of the market. Since the beginning of the year, the share of higher-priced listings with a price cut – those priced above $500,000 – have increased substantially. Columbus had a 10% point differential between it’s share of top-tier listings and bottom tier listings that experienced a price cut.

The upper tier of the market is often a leading indicator for the housing market in general. While the market has been tilted sharply in favor of sellers over the past few years, early signs are hinting that the winds may be starting to shift ever-so-slightly. While it’s certainly far to soon to call this a buyer’s these data indicate the market may be shifting.

The upper tier of the market is often a leading indicator for the housing market in general. While the market has been tilted sharply in favor of sellers over the past few years, early signs are hinting that the winds may be starting to shift ever-so-slightly. While it’s certainly far to soon to call this a buyer’s these data indicate the market may be shifting.

Current housing report – July 2018

All housing reports

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please contact The Opland Group. We offer professional real estate advice and look forward to helping you achieve your real estate goals!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Salesin; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Hilliard 43026 Lewis Center 43035 Marysville 43040 43041 New Albany 43054 Pickerington 43147 Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235