Shifting demographics and the unique housing preferences of Millennials and aging Baby Boomers have driven the condo market to new heights in recent years. With Millennials and aging Baby Boomers preferring a more compact, walkable, town center-oriented lifestyle that is generally found in more densely populated urban centers — where condos are traditionally the primary […]

Tag Archives: buying a condo

Understanding Closing Costs and How to Reduce Them When Purchasing or Refinancing a Home

When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Tips For Condo Buyers

Everyone knows there’s a big difference between renting an apartment and buying a home but not everyone realizes that buying a condo is significantly different from buying a single-family home. There are many good reasons to want to live in a condominium, but the buying process can be a minefield of potential disasters to the […]

Three Events That Will Result in the Forfeiture of Your Earnest Money

An earnest money deposit is a specific form of security deposit made in real estate transactions to demonstrate that the applicant is serious and willing to demonstrate an earnest of good faith about wanting to complete the transaction. Earnest money deposits are one of the most misunderstood parts of the home-buying process. Depending on where you live, you can expect to […]

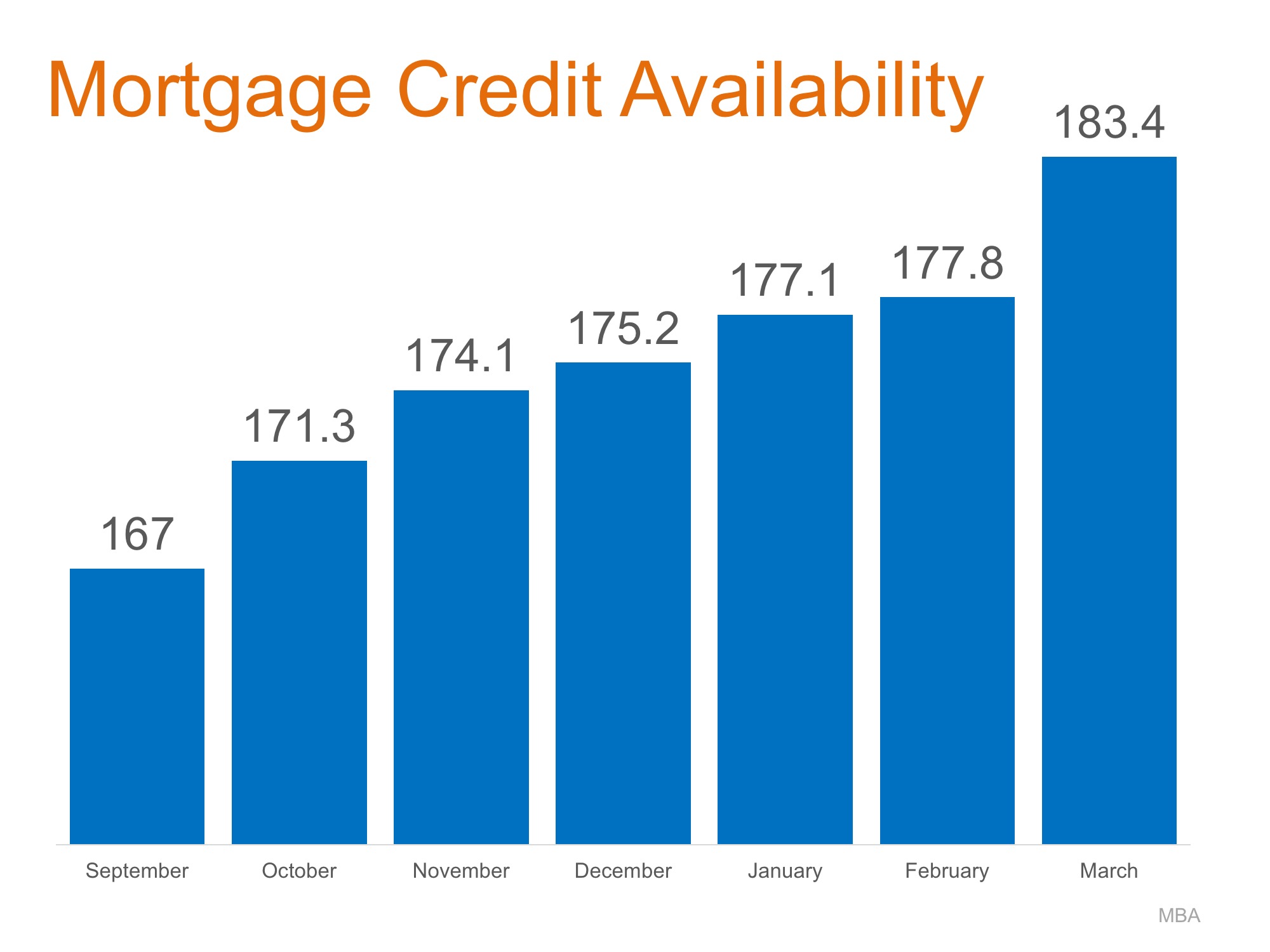

Home Mortgages: Rates Up, Requirements Easing

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Newlyweds: Here Are 5 Factors to Consider When Buying Your New Home

Now that the wedding is over, you and your spouse are on to the next exciting milestone: home ownership! But if you want to ensure yours is a positive home buying experience, you’ll want to consider the following before you start your home search. Neighborhood Marriage is a big transition and it may come with […]

A Note of Caution About HOAs and How to Spot a Bad One

Understanding HOAs The number of Americans living in common-interest communities — those governed by either a homeowners association, condo board, or cooperative — has grown from 1 percent in 1970 to 24 percent in 2013. Community associations are a growing share of the residential real estate market, however, many home owners have little understanding of the […]

Remedy Request Q&A: Should I Request Repairs or Seller Concessions

Q: The home inspection just completed on a home I have under contract turned up some issues. Should I insist the repairs be completed before closing? A: It depends. Everyone wants a smooth closing and home inspection negotiations are definitely a place where a deal can fall apart. Here are some things you’ll want to […]

Remedy Request Q&A: Should I Request Repairs or Seller Concessions

Q: The home inspection just completed on a home I have under contract turned up some issues. Should I insist the repairs be completed before closing? A: It depends. Everyone wants a smooth closing and home inspection negotiations are definitely a place where a deal can fall apart. Here are some things you’ll want to […]

FHA Eases Some Key Condo Financing Guidelines

Some positive news from FHA today on its condo financing rules, with more changes expected to come in the near future. The changes should make it easier for borrowers—both investors who want to buy more than one unit and those who are buying just their primary residence—to get financing, which has tended to be more […]