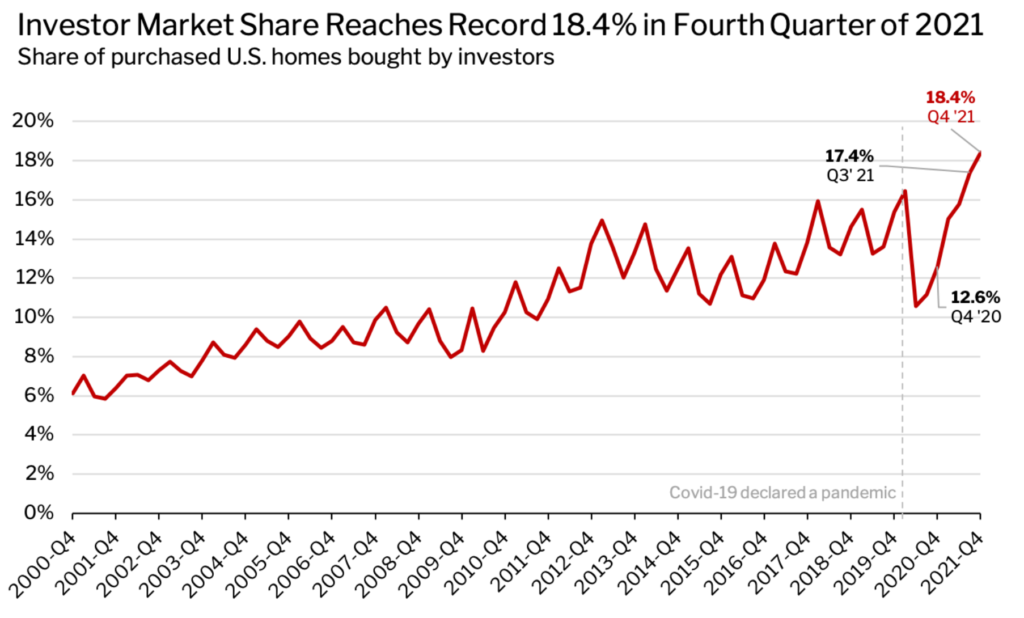

Seeing high demand and the opportunity, investors small and large alike are snatching up as much U.S. real estate as they can. Investors purchased 18.4% of homes in the fourth quarter—a record high, according to housing data.

Investors are seeing opportunities in turning homes into rentals which continue to command higher rents, or with plans to flip these homes to take advantage of rising prices.

Investors purchased 80,293 homes in the fourth quarter, up nearly 44% from a year earlier, according to Redfin’s data. Limited housing inventories are constraining investors from purchasing even more. Investors were defined in the study as any institution or business that purchases residential real estate.

The number of homes bought by investors jumped throughout 2021 as home prices rose rapidly–they were up 15% year over year in December–alongside a shortage of homes for sale. Investors are taking advantage of intense demand for rentals and increasing prices, with the average monthly rental payment for a new lease up 14% in December.

Sixty-one percent of property owners say they plan to raise the rent on at least one of their rental properties within the next 12 months, a new survey from realtor.com® shows. The most common increase will be between 5% and 10%, according to the survey.

Invitation Homes CEO Dallas Tanner told CNBC that after buying 1,500 homes in the last quarter, “we wish we could buy more. Demand is so large.” Tanner says the housing supply is tight. He says the properties they’re buying they plan to hold onto over the long haul within their ever-expanding portfolio of properties.

While record-high home prices are problematic for individual home buyers, they’re one reason why investor demand is stronger than ever. Investors are chasing rising prices because rental payments are also skyrocketing, incentivizing investors who plan to rent out the homes they buy and allowing them to pay more for the properties. The supply shortage is also an advantage for landlords, as many people who can’t find a home to buy are forced to rent instead. Plus, investors who ‘flip’ homes see potential to turn a big profit as home prices continue to soar.

Investors buying up a record share of for-sale homes is one factor making this market difficult for regular homebuyers. It’s difficult to compete with all-cash, non-contingent offers, alongside rising mortgage rates which have a smaller impact on investors because they often don’t finance their purchases. While rising mortgage interest rates may slow housing price growth over time this as buyers get priced out of the market. Rising interest rates will allow landlords to further increase their rents this as demand increases, and the alternative of purchasing a home increases dramatically.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235