For most people, buying a home is the single biggest investment they’ll make in their life. Not only is it a huge financial undertaking, but your final choice is a decision you’ll be living with for the foreseeable future. The process may sound daunting, but by taking the right steps, locating and buying your perfect […]

All posts by Jason Opland

FHA Bridal Registry Gift Funds – Down Payment Assistance for Newlyweds

Congratulations Bride and/or Groom To Be! If you’re planning to get married and buy a home in Central Ohio, but wonder where your down payment funds will come from… FHA might have a solution for you! FHA has a Bridal Registry program that allows the money you receive as a wedding gift to be used towards […]

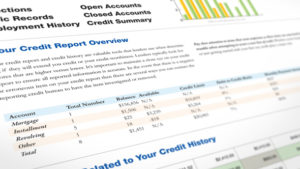

Correcting Errors & Removing Negatives From Your Credit Reports

So you’ve just discovered errors in one or more of your credit reports, or even worse, accurate references to late payments or other debt-related issues! Don’t panic, the errors can be fixed, and it’s possible that even some of the negative items can be eliminated! An individual’s credit score is one of the most influential […]

10 Things You Should NOT Do While Buying a Home

3 Steps for Unmarried Couples Looking to Buy a Home

If you’re in a committed relationship but nuptials are on the back burner, your dream of buying a home doesn’t have to be. Sixteen percent of first-time homebuyers in 2017 were unmarried couples, according to an annual report by the National Association of Realtors, the highest share the organization has recorded since 1981. Many couples […]

FOMO Drives Young Buyers Toward Ownership

They’re landing better jobs and higher salaries. They’re getting married and having kids. And some are just tired of living in their parents’ basements. Now, here’s another reason Millennials are itching to buy a house: They see photos of homes on Instagram and Facebook that their friends bought, and think: “What about me”? This “FOMO” — fear […]

The ECO-Link Loan for Energy-Efficient Upgrades & Other Home Improvements

ECO-Link is a loan program offering reduced interest rates on qualifying loans to homeowners completing energy-efficient upgrades or installing renewable energy products such as new windows, furnace, refrigerator, solar panels, etc. Eligible homeowners receive up to a 3% interest reduction on ECO-Link loans for up to 7 years. The homeowner must use at least 50% […]

HECM… a Loan Product You’ve Probably Never Heard Of

A Home Equity Conversion Mortgage (HECM or H4p, Reverse For Purchase), commonly known as the new reverse mortgage, is a HUD Program that is insured by the Federal Housing Administration (FHA) enabling retirees across the country to live a more enjoyable retirement. It is the safest and most popular type of reverse mortgage on the […]

Understanding Home Sale Contingencies

In today’s “move-up” housing market, many buyers commonly have to sell their existing home before they can purchase a new one. To protect themselves, buyers usually make the purchase of their new home contingent upon the sale of their current residence. Sellers, however, are often hesitant about accepting an offer with such a contingency for […]

The Controversial Process That Could Save You Major Eviction Headaches

Cash for Keys is a controversial process. Cash for Keys is the strategy of giving your tenants money to surrender keys and vacate the property, avoiding the eviction process altogether. We have used this technique a couple of times over the years and found great success. However, before throwing money at your tenant, let’s talk […]