The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

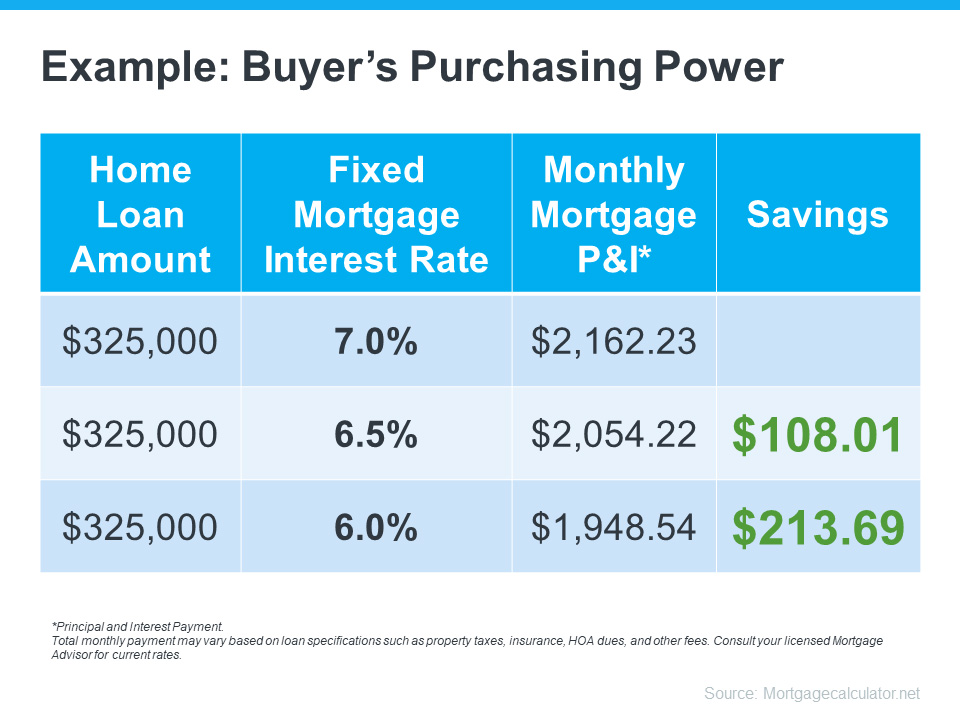

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down. As you can see, a 1% change in mortgage interest rates equates to about a 10% change in the monthly mortgage payment. This 1% change in the mortgage interest rate has the same impact as a 10% change in the price of the home. For example, if you were approved for a loan amount of $325,000 and rates increase by a factor of 100 basis points (that is a full percentage point), your purchasing power will decrease by approximately 10%, or $32,500.

What This Means for You

While you may be tempted to put your homebuying plans on hold in hopes that rates will fall. This can be counterproductive in a market such as ours in which the local economy remains incredibly strong, the population is growing, and home values are still rising, and show no signs of falling.

Home values across Central Ohio increased at an average rate of 12%, however, some markets experienced much higher rates of appreciation. For example home values in New Albany increased at an average rate of 24%, Blacklick 41%, Johnstown 40.5% (residents of these three areas have Intel to thank for the bump in their property values), Dublin 25.6%, Delaware 17.3%, Short North 14.7%, Upper Arlington 21.7%, and Worthington 16.5%. Click here for a complete list of Central Ohio Markets and their respective rates of appreciation.

No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates,and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

It’s also important to understand that the mortgage rate is temporary as you can always refinance down the road when mortgage interest rates drop. In fact some lenders are offering programs that include the option to refinance at little to no cost when rates do retreat. Another option, an adjustable rate mortgage (and ARM) with a low teaser rate. With these mortgages the initial rate is below the rate on a 15-30 year fixed rate mortgage, yet it is fixed for a set period of time, usually 2,3 or 5 years (the shorter the fixed rate period, the lower the rate). After the initial fixed period the rate adjusts to align with an index, usually LIBOR but with a limit on how much it can increase per year. Most buyers who use these ARMs do so with the intention of refinancing before the fixed term expires, or selling the home prior to the expiration.

The Bottom Line

While your ability to buy a home and your overall buying power could be impacted by changing mortgage rates. If you’re thinking about making a move, now is still the best time to do so as local home values are only expected to continue to rise.

If you’re thinking about buying a home and you’re interested in learning more, and establishing a plan for your purchase, give us a call at 614.332.6984. We have the experience and resources to help you achieve your real estate goals and look forward to serving you!