If you’re looking to move up, into a larger and more expensive home, we have some good news for you… it has never been more affordable to move up to a luxury home.

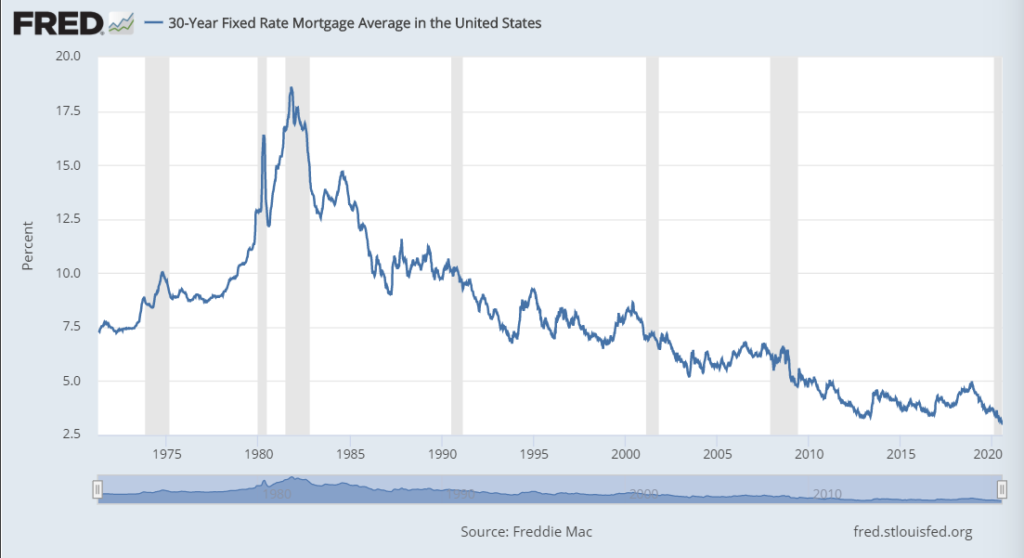

Mortgage interest rates are currently below 3%. This represents the lowest levels in the last 50 years.

These low interest rates dramatically impact your monthly mortgage payment allowing you to afford a larger, more expensive home.

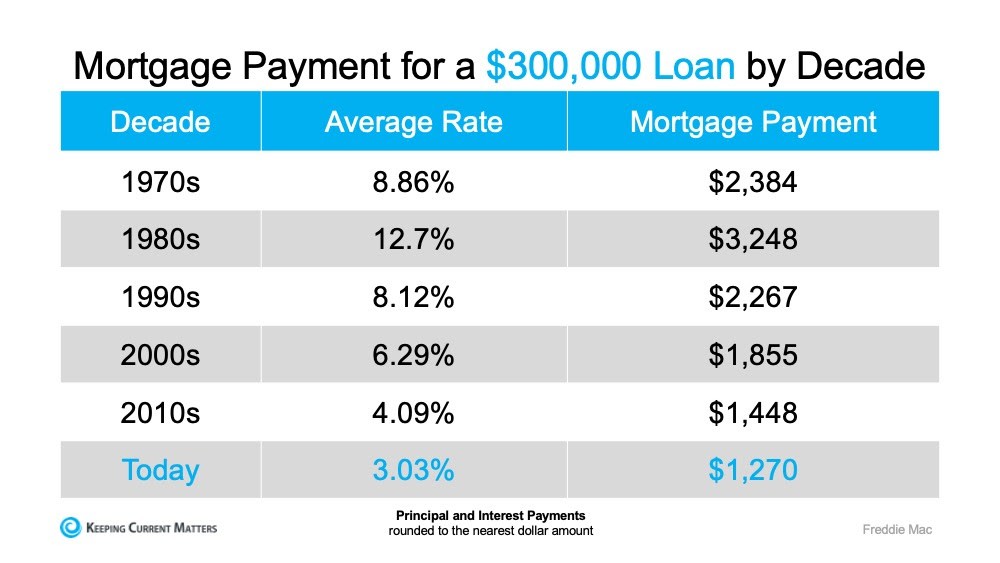

The chart below shows monthly payments (principal & interest) on a $300,000 loan over the past 5 decades. In the 1980’s homeowners had to pay 2.5 times what you pay now.

How Housing Affordability Increased in Just One Year

For most of 2019 mortgage interest rates were greater than 4%. Buyers paid $1,432 a month for their $300,000 mortgage.

With interest rates below 3%, the same loan would be just $1,265 a month, saving home buyers $167 a month, $2,004 per year, and $60,120 over the life of the mortgage.

If you can afford $1,432 a month, your loan amount would increase over 10% to $332,655 at 3% interest.

Why Move Up Buyers are Triple Winners

Let’s assume you currently own an average suburban home worth $300,000, and you want to move up to a $500,000 luxury residence.

Here’s how you win 3 times:

- Appreciation of Current Home Your current house has increased in value substantially. Over the past 12 months the average price of a home between $200,000 and $350,000 has increased by 5.9%.

- Low Appreciation of Upscale Homes Luxury homes on the other hand did not appreciate at the same rate. They take longer to sell, and owners are more likely to accept offers below list price. (Builders continued building in the segment of the market and thus inventory levels are significantly greater than they are in the starter segment of the market).

- Low Interest Rates Your affordability has increased by 10% in just one year due to interest rates below 3%.

If you are ready to MOVE-UP and WIN, Call or Text us at 614.332.6984!