Before buying a home, you would ideally save enough money for a 20% down payment. You can get a home loan with less than a 20% down payment, but you’ll probably have to pay for mortgage insurance. The purpose of the insurance is to protect the mortgage company if you stop making your monthly mortgage payments and default on the note.

A smaller down payment (less than 20%) means lenders take on more risk because they’re getting less money upfront. Mortgage insurance ensures a lender recovers at least some of their investment, allowing borrowers with less than a 20% down payment to become homeowners.

The FHA has a similar mortgage insurance premium requirement for those taking out FHA mortgages, with somewhat different rules. This article is about PMI, but the reasons to avoid it apply to both types of loans.

PMI is a great way to buy a house without having to save as much for a down payment. Sometimes it is the only option for new homebuyers.

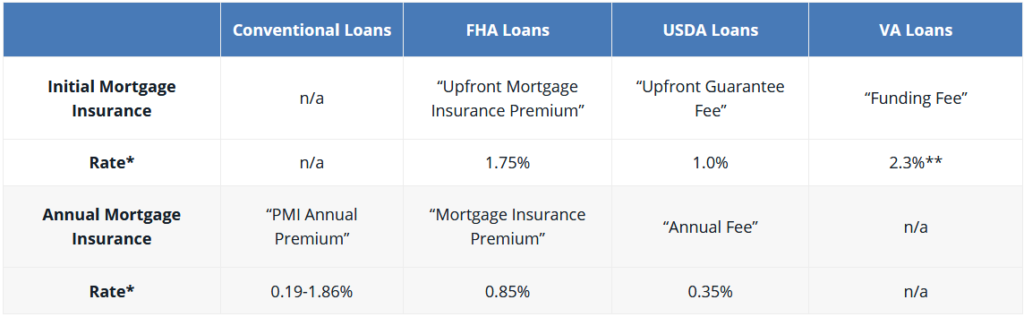

Cost of Mortgage Insurance by Loan Type

PMI costs vary by loan program (see the table below). But in general, mortgage insurance is about 0.5-1.5% of the loan amount per year. So for a $250,000 loan, mortgage insurance would cost around $1,250-$3,750 annually — or $100-315 per month.

*Mortgage insurance rates are shown as a percentage of the loan amount

**VA funding fee is 2.3% for first-time use, and 3.6% for subsequent uses

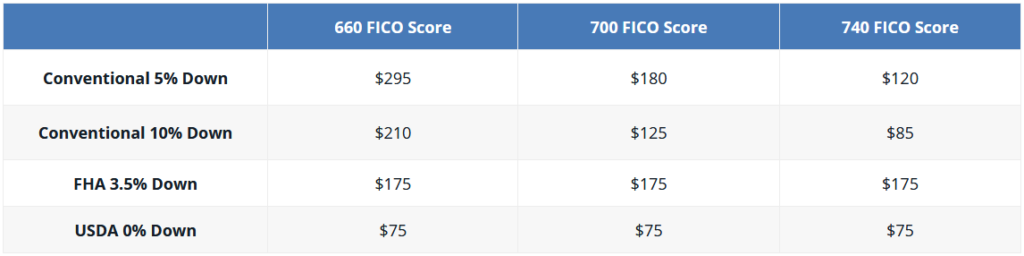

Calculating Mortgage Insurance by Credit Score

The following chart compares cost differences between the three major types of mortgage insurance, based on a $250,000 loan amount, and varying credit levels.

NerdWallet’s PMI calculator allows you to estimate how much you’ll pay for PMI.

NerdWallet’s PMI Calculator uses your home price, down payment, mortgage interest rate, mortgage insurance rate and loan term, among other things.

Using this calculator can help you to determine how much home you can afford. Many borrowers don’t mind paying PMI if it means they can buy a house sooner. But if the added cost of PMI pushes you over your monthly budget, you may want to shop in a lower price range or postpone your home purchase until your credit score, down payment amount and debt-to-income ratio, or DTI, improve.

Can I lower my PMI costs?

Mortgage insurance rates vary by lender. Your credit score, DTI and loan-to-value ratio, or LTV, can also have an effect. Borrowers with low credit scores, high DTIs and smaller down payments will typically pay higher mortgage insurance rates. Improving your credit score, paying down debt and putting down as much as you can afford may reduce your PMI costs.

How to Avoid Paying PMI

In some circumstances, PMI can be avoided by using a piggyback mortgage. It works like this: If you want to purchase a house for $200,000 but only have enough money saved for a 10% down payment, you can enter into what is known as an 80/10/10 agreement. You will take out one loan totaling 80% of the total value of the property, or $160,000, and then a second loan, referred to as a piggyback, for $20,000 (or 10% of the value). Finally, as part of the transaction, you put down the final 10%, or $20,000.

By splitting up the loans, you may be able to deduct the interest on both of them and avoid PMI altogether. Of course, there is a catch. Very often the terms of a piggyback loan are risky. Many are adjustable-rate loans, contain balloon provisions, or are due in 15 or 20 years (as opposed to the more standard 30-year mortgage).

If a piggyback loan isn’t an option, and private mortgage insurance is required to close your home loan, you may be able to get rid of PMI later. You can drop PMI when:

- You achieve 80% LTV (or 78% LTV in some cases) either by paying down your loan or getting a higher appraised value.

- You pass the halfway point of your mortgage term.

- You refinance your mortgage, and the new loan balance is less than 80% of the home’s value.

Use PMI as a Wealth-Building Tool

Homeownership is the primary means of wealth building in the U.S.

While owning a home is no path to quick riches. Rather, it’s an investment that pays off over time, even considering cyclical downturns.

Long-term housing data supports this fact as according to the government lending agency FHFA, home values are up more than 140% since 1991. That means a home worth $100,000 in January 1991 is worth $240,000 today.

Over that time, inflation has risen 75%, says the Bureau of Labor Statistics. A first-time home buyer in 1991 has beat inflation, plus made an additional 65% return on investment!

Inflation-adjusted return is a tangible way to look at wealth increases, but there are non-tangibles, too.

For instance, a homeowner who purchased a home in 1991 is likely near the end of its 30-year fixed mortgage. Soon, the homeowner will be mortgage-free, significantly reducing their total cost of living. Plus… the owner will hold a considerable asset.

Yet, a person who chose to rent in 1991, and continued to do so, now pays ever-increasing rental prices.

Worse, it’s likely this person has no sizeable asset unless he or she has contributed to a retirement account or other investment consistently over two or three decades.

A house is a forced savings account. Housing expenses are required whether you rent or own. But when you own, you deposit a small chunk toward your future wealth.

So what does PMI have to do with this? It starts the wealth-building process sooner allowing you to purchase a home long before you would have had you had to come up with the full 20% down payment. This allows you to position yourself on the winning side of rising home values.

And, without PMI, you may be unable to save fast enough to catch up with home prices. Securing a home at today’s prices is a solid advantage.

The Bottom Line

PMI is expensive. Unless you think you’ll be able to attain 20% equity in the home within a couple of years, it probably makes sense to wait until you can make a larger down payment or consider a less expensive home, which will make a 20% down payment more affordable.

If you, or someone you know is considering Buying or Selling an Investment Property in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235