Shifting demographics and the unique housing preferences of Millennials and aging Baby Boomers have driven the condo market to new heights in recent years. With Millennials and aging Baby Boomers preferring a more compact, walkable, town center-oriented lifestyle that is generally found in more densely populated urban centers — where condos are traditionally the primary […]

Tag Archives: financing

Adjustable Rate Mortgages (ARMs) Explained

Adjustable Rate Mortgages (ARMs) With an adjustable rate mortgage, the interest rate and monthly payments varies according to a specific benchmark. The initial interest rate is usually fixed for a period of time after which it is reset periodically. The interest rate paid by the borrower will be based on the benchmark plus an additional spread, called an ARM […]

Using a FHA Mortgage to Buy a Home

In recent years FHA loans have taken on renewed importance for today’s mortgage borrowers. Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if […]

Home Mortgages: Rates Up, Requirements Easing

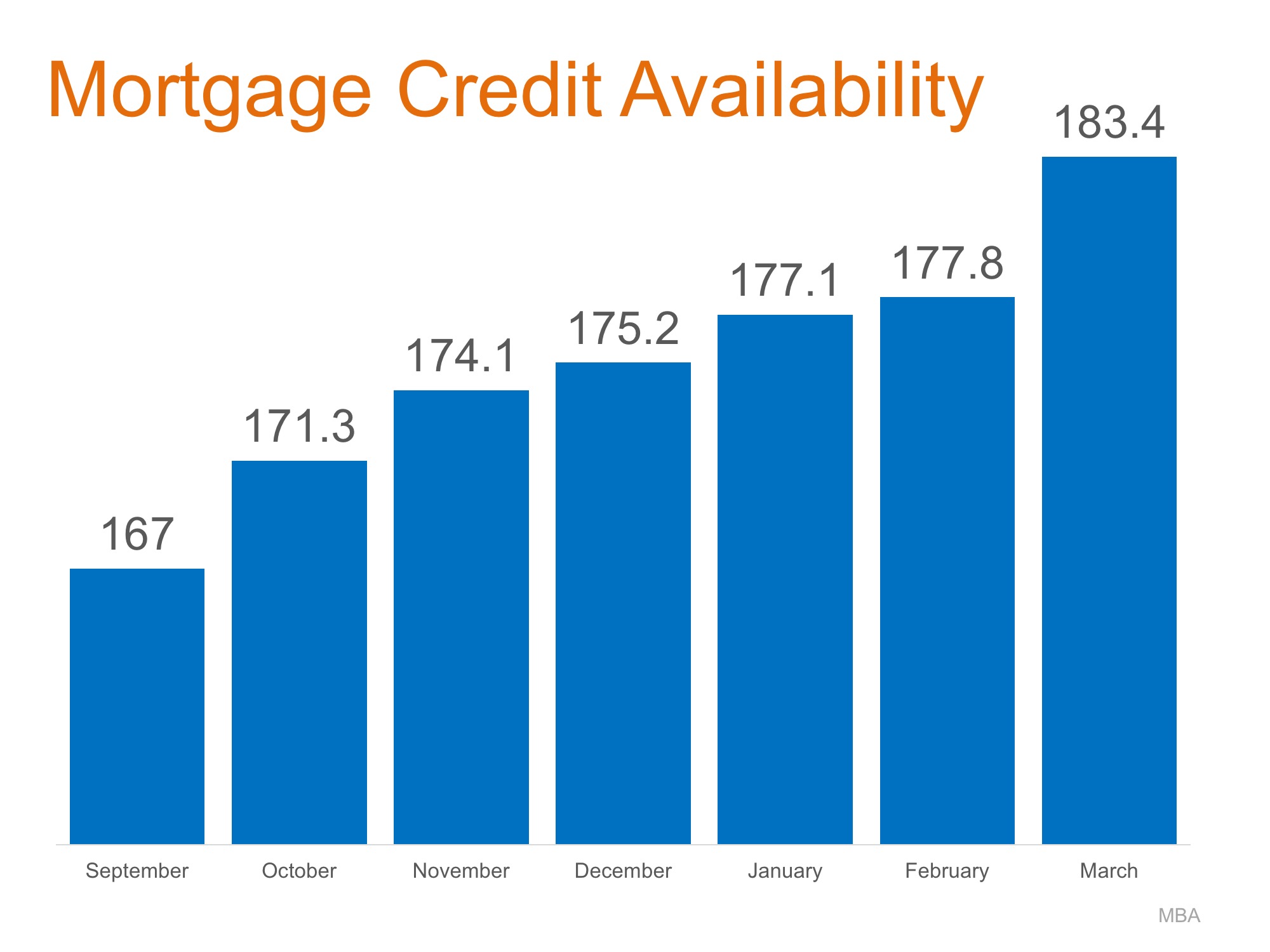

While the media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac), a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortgage Bankers Association (MBA) quantifies the […]

Self-Employed? Keys to Getting Approved for a Mortgage and Buying a Home

If you’re self-employed your office might be a built-in desk in the corner of a spare bedroom, a downtown co-working space, or the front seat of your car. The Bureau of Labor Statistics reports there are 15 million self-employed workers in America living the dream, being their own boss. Sure, it can be a struggle, […]

Lenders Loosening Mortgage Underwriting Standards as Rates Rise

LendingTree’s monthly Credit Accessibility Report shows the average accessibility score for U.S. borrowers rose from 103 to 106 between July and August, indicating that borrowers had easier access to mortgage credit making it easier for homebuyers to qualify for a mortgage. The Credit Accessibility score is benchmarked at 100, using data from the full year […]

FHA Eases Some Key Condo Financing Guidelines

Some positive news from FHA today on its condo financing rules, with more changes expected to come in the near future. The changes should make it easier for borrowers—both investors who want to buy more than one unit and those who are buying just their primary residence—to get financing, which has tended to be more […]