Sellers: Get your chef’s kitchens, media rooms and outdoor kitchens ready as these are the kinds of amenities that buyers seek when shopping for a luxury home.

In a new survey, realtor.com® uncovered the priorities, buying motivations and expectations of transaction-ready luxury homebuyers. According to the survey, 13% of respondents report they are currently ready to buy a luxury home, and another 26% are considering a high-end home purchase.

Percentages of surveyed consumers currently considering a luxury home purchase:

- 13% of respondents stated that they are looking to purchase a high-end luxury home;

- 26% said they might be considering a high-end luxury home;

Most popular price points at which surveyed consumers stated that luxury housing begins, by U.S. region:

- Northeast (ME, VT, NH, NY, NJ, MA, CT, RI, MD, DE, PA) $1 million +

- Pacific (CA, OR, WA, AK, HI) $1 million +

- Mountain (MT, ID, WY, CO, UT, NV, AZ, NM) $1 million +

- South Central (AL, MS, TN, AR, LA, TX, OK) $500,000 +

- North Central (KY, OHIO, IN, IL, MI, WI, MN, IA, NE, KS, ND, SD) $500,000 +

- South Atlantic (VA, WV, NC, SC, GA, FL) $500,000 +

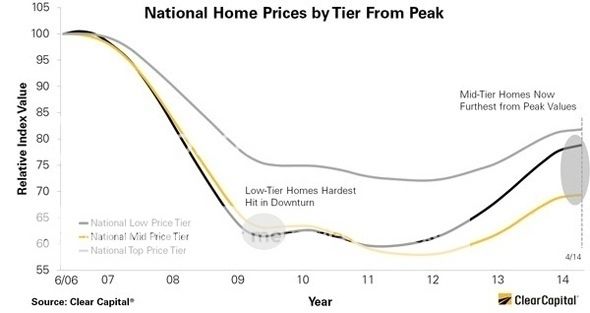

The luxury homebuyer is an important contingent of today’s real estate market, as luxury homes tend to dictate and drive trends that carry throughout the balance of the marketplace and into the lower price tiers. We are seeing large portions of home buyers throughout the country – from 23% in the Northeast region and 23% in the South Atlantic – eyeing luxury homes and this segment of the market is strong and benefiting from increased consumer confidence, rising financial markets and increasing portfolio values, and increasing strength in the overall economy. Many luxury markets are benefiting from foreign investor demand and overseas buyers who recognize investment opportunities to purchase luxury properties in sought after markets at prices that remain well below levels seen at the market’s peak.

Of the survey respondents who are currently looking for a luxury home:

- Most popular reasons high-end buyers started their luxury home search:

- 19% shared that recent career success prompted their home search;

- 17% of luxury home buyers indicated they entered the market because they are newly retired;

- 14% indicated that they are entering the market as an investment;

- 12% revealed they have entered the market to buy their first home.

- Biggest challenges of searching for a high-end luxury home:

- 40% of luxury buyers cited finding a property that meets their family’s needs;

- 20% shared their biggest challenge is the limited number of properties offered;

- 11% tout ultra-unique properties with limited universal appeal;

- 8% are challenged by gaining access to mortgage loans.

- Most important home features when considering a luxury purchase:

- 54% of luxury buyers indicated a chef’s kitchen as an important feature;

- 44% consider the home’s views as significant;

- 38% responded that the square footage of the property is key attribute;

- 36% included the presence of an expansive master suite as an important factor.

- Importance of resale value to those in the market for a luxury home:

- 35% indicated it is very important;

- 29% shared it is neither important or unimportant

- 27% of luxury buyers said resale value is extremely important;

- Only 8% consider resale value to be unimportant.

- Regional breakdown of current luxury home buyers:

- 23% live in South Atlantic (VA, WV, NC, SC, GA, FL);

- 23% are in the Northeast (ME, VT, NH, NY, NJ, MA, CT, RI, MD, DE, PA);

- 18% live in North Central (KY, OH, IN, IL, MI, WI, MN, IA, NE, KS, ND, SD);

- 15% are in the Pacific (CA, OR, WA, AK, HI);

- 14% live in South Central (AL, MS, TN, AR, LA, TX, OK);

- 7% selected Mountain (MT, ID, WY, CO, UT, NV, AZ, NM).

Of the survey respondents who are NOT in the market for a luxury home:

- If respondents had an extra million dollars to invest in a home, they would use it in the following ways:

- 28% would sell their current home and purchase a new home;

- 23% would keep their current home and purchase either a new or vacation home;

- 14% indicated they would purchase several homes;

- 14% would purchase their first home.

- If respondents were in the market for a luxury home, they indicated the following priorities for their property search would be:

- 55% of respondents desired a view;

- 45% desired an chef’s kitchen;

- 32% indicated an outdoor living area (outdoor kitchen, living room, fire pit, bar) would be key;

- 29% wished for a luxury pool (infinity, grotto, water slide) as imperative.

- If these respondents were in the market for a luxury home, their most desirable locales for purchase would be:

- 37% would buy a waterfront property;

- 19% would like a countryside property;

- 14% would choose a mountainside property;

- 13% desire a suburban property.

- The respondents not currently in the market for a luxury home indicated that their top stylistic preferences would be:

- 13% would want a traditional home;

- 13% would prefer a contemporary home;

- 11% would select a coastal home;

- 11% would choose a modern home.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please contact The Opland Group. We offer professional real estate advice and look forward to helping you achieve your real estate goals!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley Columbus Delaware Downtown Dublin Gahanna Grandview Heights Granville Grove City Groveport Hilliard Lewis Center New Albany Pickerington Polaris Powell Upper Arlington Westerville Worthington