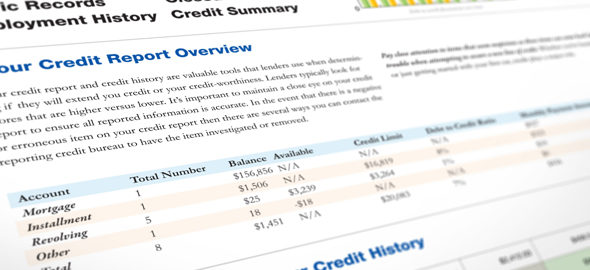

So you’ve just discovered errors in one or more of your credit reports, or even worse, accurate references to late payments or other debt-related issues! Don’t panic, the errors can be fixed, and it’s possible that even some of the negative items can be eliminated! An individual’s credit score is one of the most influential factors a bank will use when considering a loan application, your score will have a significant impact on the rate you are offered.

How To Dispute Errors on Your Credit Report

1. Make a copy of your credit report and circle every item you believe is incorrect.

2. Write a letter to the reporting agency (the address will be printed on the report). Explain each dispute and request an investigation to resolve the issues. If you have supporting paperwork, send it along, coding pages to match dispute paragraphs. Do not send your originals.

3. Send all materials by certified mail, return receipt requested, so that you can prove the packet was received.

4. Send a similar letter of dispute to the creditor whose reports you disagree with (most billing statements include a special mailing address for disputes).

Your dispute might involve personal information, such as your place of employment or your current address. A copy of a pay stub or W2 should resolve an employment issue. A copy of your driver’s license or a utility bill in your name can verify your address.

The reporting agency will initiate an investigation, contacting your creditors to verify the accuracy of the information. If the creditor cannot verify that the entry is correct, it must be removed. When the investigation is complete, the agency must send you a free copy of your report if changes were made.

If the investigation uncovers an error, you have the right to ask that a corrected version of your credit report be sent to everyone who received the report during the past six months.

Tip: Contact your creditor first, then allow a bit of lead-time before you submit the dispute to the reporting agency. By the time the dispute is verified, the creditor will hopefully have corrected the error.

Online Disputes

You can initiate an investigation from your online credit report. It’s an intuitive process–just follow the links and check the disputed items as directed. There sometimes isn’t a place for remarks–you’ll simply check a multiple-choice reason for each dispute.

When Changes Aren’t Made

If the agency verifies that the information is accurate, it must provide you with a written notice that includes the name, address, and phone number of the provider. If you still disagree, you can initiate another investigation.

If your attempts to correct an entry are unsuccessful, you can ask the reporting agency to insert a 100-character explanation next to it that explains your side of the story.

Negative Entries

Bankruptcies remain on your credit report for ten years, while other types of entries are generally reported for seven years. If an account that was previously past due has been brought current, and has been either paid off or kept current for at least a year, the creditor might agree to an early deletion of the past due references.

Write a letter to your creditor and request that the negative entries be removed. There’s no guarantee, but they’ll often comply if they see you are up to date and handling your account in a positive way.

Another tactic is to dispute a negative item even if you believe it is accurate. You’ll have to follow your conscience on that one!

Need Help With Letter Formats?

About.com’s Credit/Debt Management Guide, Michael T. Killian, offers a set of sample letters to help you file disputes and write correspondence regarding many other credit-related issues.

If you’d prefer to hire someone to handle the job of restoring your credit for you, please feel free to give us a call at 614.332.6984 and we’ll be more than happy to refer you to a specialist.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickeringto, 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235