The spring housing market is in full swing, and demand remains strong. While it has never been easier or more profitable to sell a home, buyers are less optimistic.

For months now, homebuyers have been challenged by the scarcity of available homes, the bidding wars that ensue, and the possibility of being priced out of the market or settling for a home below expectations.

2022 interest rate hikes

Shortly after the Federal Reserve announced it would act to reduce inflation and tighten the money supply (by tapering its purchases of mortgage-backed securities and raising the federal funds rate throughout 2022), in anticipation of these actions competitive market forces led to mortgage interest rate increases as early as January.

Now, with interest rates continuing to climb — although still historically low — home prices have begun to stabilize, but the purchasing power of homebuyers has already diminished. None of this is surprising, given the law of supply and demand, but what options may be available to the home buying public?

With higher rates come larger mortgage payments

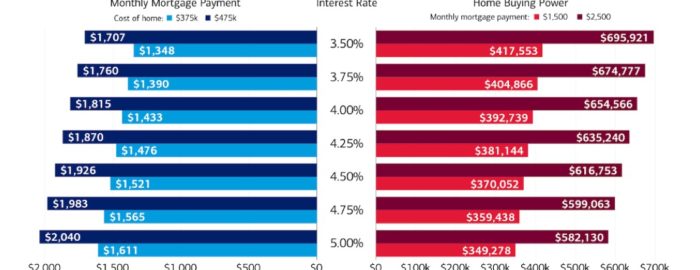

The bar graphs above illustrate the outcome that rising mortgage interest rates have on overall home costs.

On the left-hand side of the graph we’re tracking the increase in mortgage payments on homes costing $375,000 — the national median home price — or $475,000. For example, based on a rate increase from 4.0% to 4.5%, monthly mortgage payments would rise $88 or $111, respectively.

…and decreases in purchasing power

On the right-hand side, we’re showing the loss in home buying power if interest rates also rise from 4.0% to 4.5%.

For homeowners looking for a $1,500 monthly P&I mortgage payment, home purchase price affordability decreases from $393,000 to $370,000, a $23,000 decline. Similarly, for homeowners looking for a $2,500 payment, their affordability decreases from $655,000 to $617,000, a $38,000 decline.

And now, better news for homebuyers

In today’s healthy economy, with near-full employment and increasing wages, homebuyers still want to buy and lenders want to lend. Additionally, as mortgage rates rise, so do rents; homeowners build equity, renters don’t.

With nearly 10,000 millennials turning 40 every day, buyers are out there. And lenders are providing home buying educational and financial assistance through Better Money Habits®, reduced down payments as low as 3.0% and grants to qualified buyers, especially to many first-time homebuyers.

Due to rising interest rates, an advantage this year’s homebuyers might soon have is that a degree of sanity could be returning to the marketplace. When higher rates actually reduce the number of offers, some sellers will once again be willing to negotiate. More offers will include inspections and possibly the return of remedy requests. Plus, fewer offers will be made exclusively in cash, well above the listing price. We predict a healthier seller-buyer balance will slowly be returning to the Columbus and Central Ohio Housing Market.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickerington 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235

Click here for more information about the Central Ohio housing market.