Many renters feel buying a home is an impossible dream. But consider this: A landlord expects to make a profit after paying the mortgage, taxes, insurance, repairs and other expenses. The landlord’s only income for the rental property is the rent paid by the tenants. As time goes on, and the value of the property appreciates, rents rise and their profit margin grows.

If you want more control over your monthly expenses (avoiding future rent increases), and more importantly a share in the profits, buying is the choice for you. If you’d prefer to continue putting money in your landlord’s pocket and adding to their net worth, don’t make any changes and continue renting. Before you choose you may also wish to consider the following. The basic premise of renting: Someone buys a property whether it be a single-family home or a 300-unit apartment complex. They find tenants, i.e. people to pay their mortgage for them, and in return they allow those people to live there. You are always buying a house, when you are renting you are just buying it for someone else.

Lets say that you are renting an apartment with two of your friends. All three of you pay the same amount each month for the right to live there but when you move out, what do you have to show for your time and money spent at the apartment? Answer: NOTHING! Now, let’s say that you owned the house and rented rooms to those two friends. Your roommates are paying at least 2/3 of the mortgage for you (it’s quite possible that they will actually be paying more) however, YOU get to deduct all of the mortgage interest and property taxes from your income taxes each year (in the first few years of your mortgage over 90% of the payment is interest)! So, by keeping those same roommates you were living with before and simply having them live in YOUR home, you can reduce your tax burden saving thousands of dollars each year while building equity in the home you are on the fast track to owning!

The benefits of ownership don’t stop there! A home is an asset that appreciates, that is it increases in value over time. The rate at which a home appreciates is the result of factors such as its location, that is, the higher the demand for a home in a location such as a city or subdivision, the higher the rate of appreciation. Other factors include the cost of building supplies associated with the construction of a home and the general health of the local economy in the town / city the home is located. Appreciation rates in Columbus tend to average around 3 to 4% (which means a $200K home is likely to appreciate $8,000 a year!).

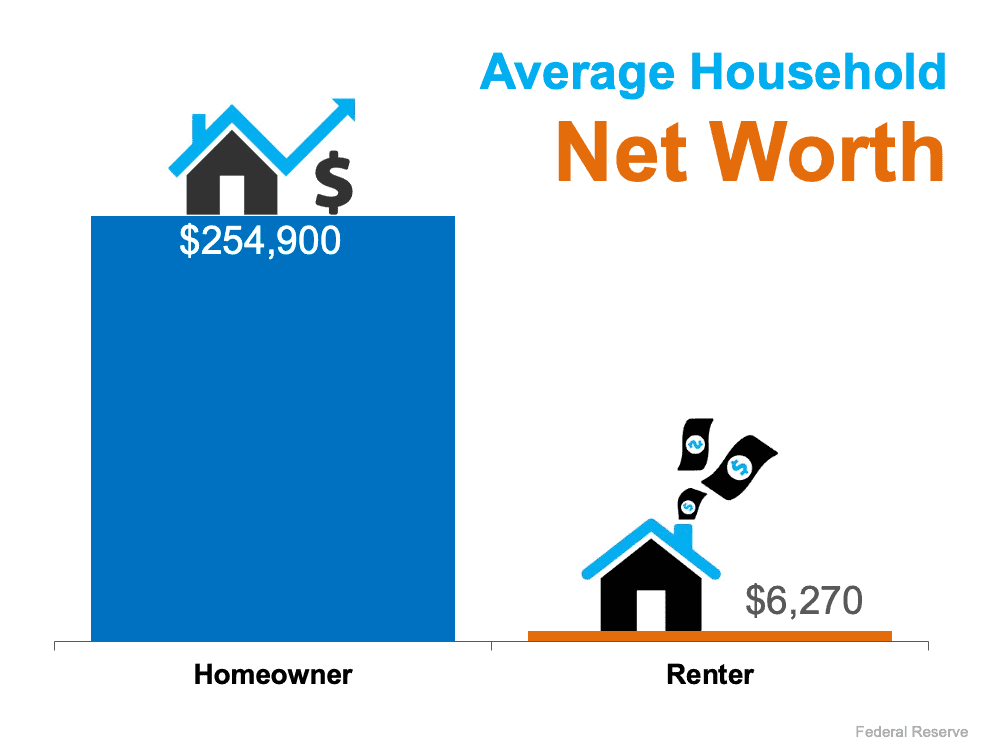

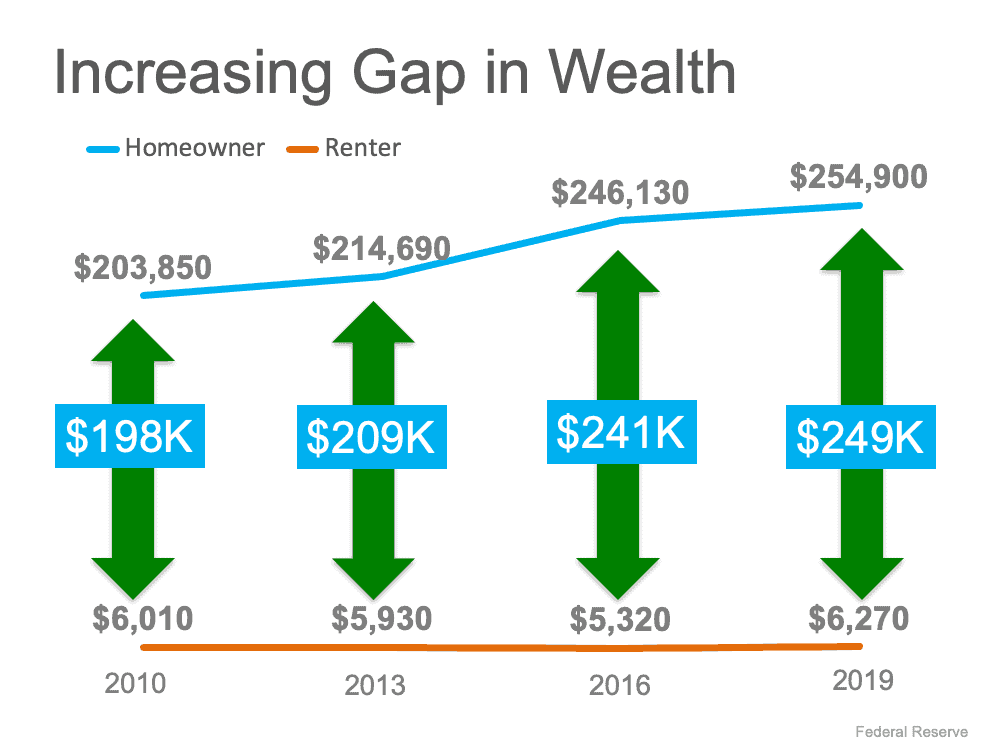

Furthermore, if you purchase your home with a mortgage, a home is what’s called a leveraged asset. That is, while you may only put a few thousand dollars down when purchasing the home, it appreciates based on its total value rather than the value of your down payment. For example, if you purchase your $200K home with a $5,000 down payment, your home (and thus your net worth) would increase in value by $8,000 ($200,000 x 1.04) rather than the $200 ($5,000 x 1.04) you would have earned on your down payment! Buying a home is one of the smartest decisions most people will ever make! But don’t take our word for it, take the Federal Reserve’s. It’s Survey of Consumer Finances has consistently found a huge gap between the wealth piled up by homeowners and that accumulated by renters.

Home ownership builds wealth through the forced savings of paying down a mortgage, appreciation of the asset and the tax benefits the home provides.

Inventory levels and the selection of homes available for sale has increased giving buyers more options to choose from! While mortgage interest rates have risen, they are still well below historical averages not to mention we do have access to discounted rates, rate buy downs, and down payment assistance programs that save our clients thousands! Quite simply, now is still a great time to buy a home!

Think home prices are too high and the dream of home ownership is out of your reach? Think again! You can buy a 2-bedroom condo in Dublin for under $160,000! There are many options available to buyers offering payments right around, or perhaps even less than what you are currently paying in rent! (and this is before you factor in the tax savings you’ll incur as an owner!)

For those looking to buy their dream home with $600,000 or more to spend, there are lots of motivated sellers in this price point!

Again, if you’re thinking of buying a home it is still an excellent time to do so! Rates are low (and there are ways to bring these rates down), inventory levels are on the rise, many sellers are anxious and prices are still well below the national average but continue to rise.

Think before you rent! Pick up the phone and begin the path to financial freedom!

Still not sure? This calculator from the New York Times can help you determine if given your situation, Is it Better to Rent or Buy?

Here’s another Rent vs Buy Calculator from Lending Tree to determine if renting or buying makes better sense for you.

If you, or someone you know is considering Buying or Selling a Home in Columbus, Ohio please give us a call and we’d be happy to assist you!

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley 43209 Columbus 43201 43206 43214 43215 Delaware 43015 Downtown Dublin 43016 43017 Gahanna 43219 43230 Grandview Heights 43212 Galena 43021 Hilliard 43026 Lewis Center 43035 New Albany 43054 Pickeringto, 43147 Polaris Powell 43065 Upper Arlington 43220 43221 Westerville 43081 43082 Worthington 43235