Shifting demographics and the unique housing preferences of Millennials and aging Baby Boomers have driven the condo market to new heights in recent years. With Millennials and aging Baby Boomers preferring a more compact, walkable, town center-oriented lifestyle that is generally found in more densely populated urban centers — where condos are traditionally the primary […]

Tag Archives: Home Loans & Mortgages

Understanding Closing Costs and How to Reduce Them When Purchasing or Refinancing a Home

When you take out a mortgage, whether it be to purchase or refinance a home, you must pay closing costs. These costs can vary and it’s important to know which costs are negotiable. There are fees that must be paid to the lender, those that must be paid to third parties (such as title/escrow and insurance), and […]

Can’t Afford 20% Down? You have Options!

You want to buy your own home or perhaps you’re a move up buyer looking to climb the property ladder and purchase a larger home. But there’s just one problem: You don’t have the cash for a 20% down payment. What should you do? First, let’s assess your current situation: Are you a first-time homebuyer? Or […]

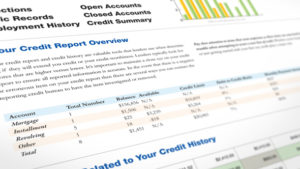

What is a Good Credit Score and What Do You Need to Buy a Home?

No number is more important to prospective home buyers than their credit score. Simply put, these three digits are a numerical representation of your existing debt, and your track record paying off these debts, everything from credit cards to college loans. If you’ve applied for a mortgage to buy a home, lenders check your credit score. If it’s high, […]

10 Questions to Ask the Lender When Applying for a Mortgage

Preparing to buy a home? We encourage buyers to ask prospective lenders these 10 important questions at or prior to mortgage application. (1) What are your qualifying guidelines? Ask about requirements relating to your income, employment, assets, liabilities and credit history. Qualifications for 1st-time homebuyer programs, Veterans Affairs loans and other government-sponsored mortgages are typically less stringent. […]

Sources For Your Down Payment

Finding down payment cash is often the biggest challenge to buying a home. Rest assured we have lots of ideas to help you overcome this hurdle. PMI While PMI or Private Mortgage Insurance has pretty much made the traditional 20% down payment a thing of the past, buyers who are able to put more money […]

10 Things You Should NOT Do While Buying a Home

Using a FHA Mortgage to Buy a Home

In recent years FHA loans have taken on renewed importance for today’s mortgage borrowers. Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if […]

Employers Can Now Contribute to Workers’ Down Payments

A new program allows employers to help workers’ down payment on a home, similar to how companies contribute to a 401(k). HomeFundMe, a Fannie Mae and Freddie Mac-approved down payment crowdfunding platform, allows borrowers to crowdfund their down payment from several sources, including their employer. CMG Financial, a mortgage banking firm, created the HomeFundMe program. Employers can […]